Just as 2022 was a challenging year across the board, 2023 was a great one. Let’s check in to see how the ultra-wealthy are set up heading into the new year. 👀

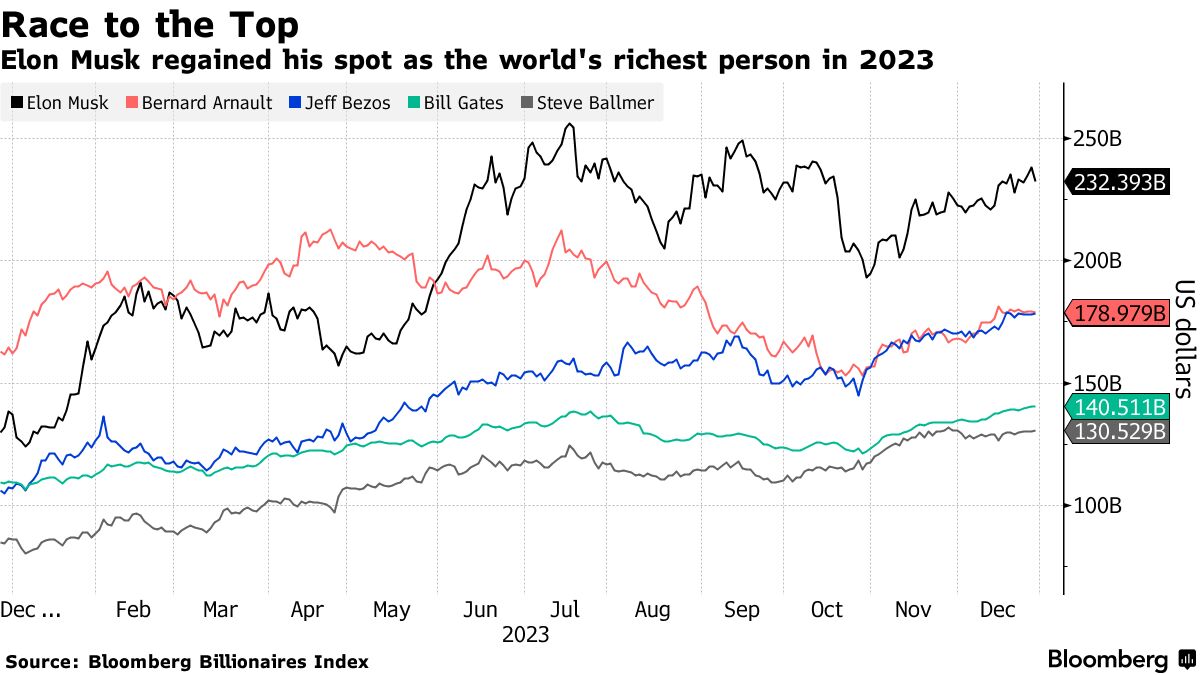

The Bloomberg Billionaires Index indicated that the net worth of the wealthiest 500 people soared by $1.5 trillion this year, recovering all of the $1.4 trillion lost in 2022. That came despite fears of recession, elevated inflation, higher interest rates, and geopolitical turmoil as markets (and the economy) climbed the “wall of worry.”

With public markets rebounding sharply this year, billionaires with a lot of their wealth tied up in the value of companies benefitted greatly. Elon Musk reclaimed the top spot from luxury retail giant Bernard Arnault due to Tesla shares more than doubling. 📈

Despite the massive tailwinds helping asset prices in 2023, not everyone fared well. Activist investor Carl Icahn saw his fortunes fall over $15 billion after short-seller Hindenburg Research went after his publicly traded entity. Japanese investor Masayoshi Son also saw his wealth fall again this year as SoftBank struggles with weak private tech valuations and a slow dealmaking market. 📉

Lastly, we must mention Francoise Bettencourt Meyer, the L’Oreal heiress, who became the first woman to cross the $100 billion mark. The French beauty empire founded by her grandfather had one of its best stock market performances in decades, with shares rising to a record high this week. That propelled her net worth and made her the 12th richest person in the world. 💰