Semiconductor stocks remain the focus of investors and traders, with Nvidia and Super Micro Computer pushing to all-time highs. The industry is starting the week with several analyst upgrades as Wall Street continues to chase these companies higher. 🌠

Despite the growing concern that the fundamentals may not fully support these short-term surges in price, the path of least resistance remains higher.

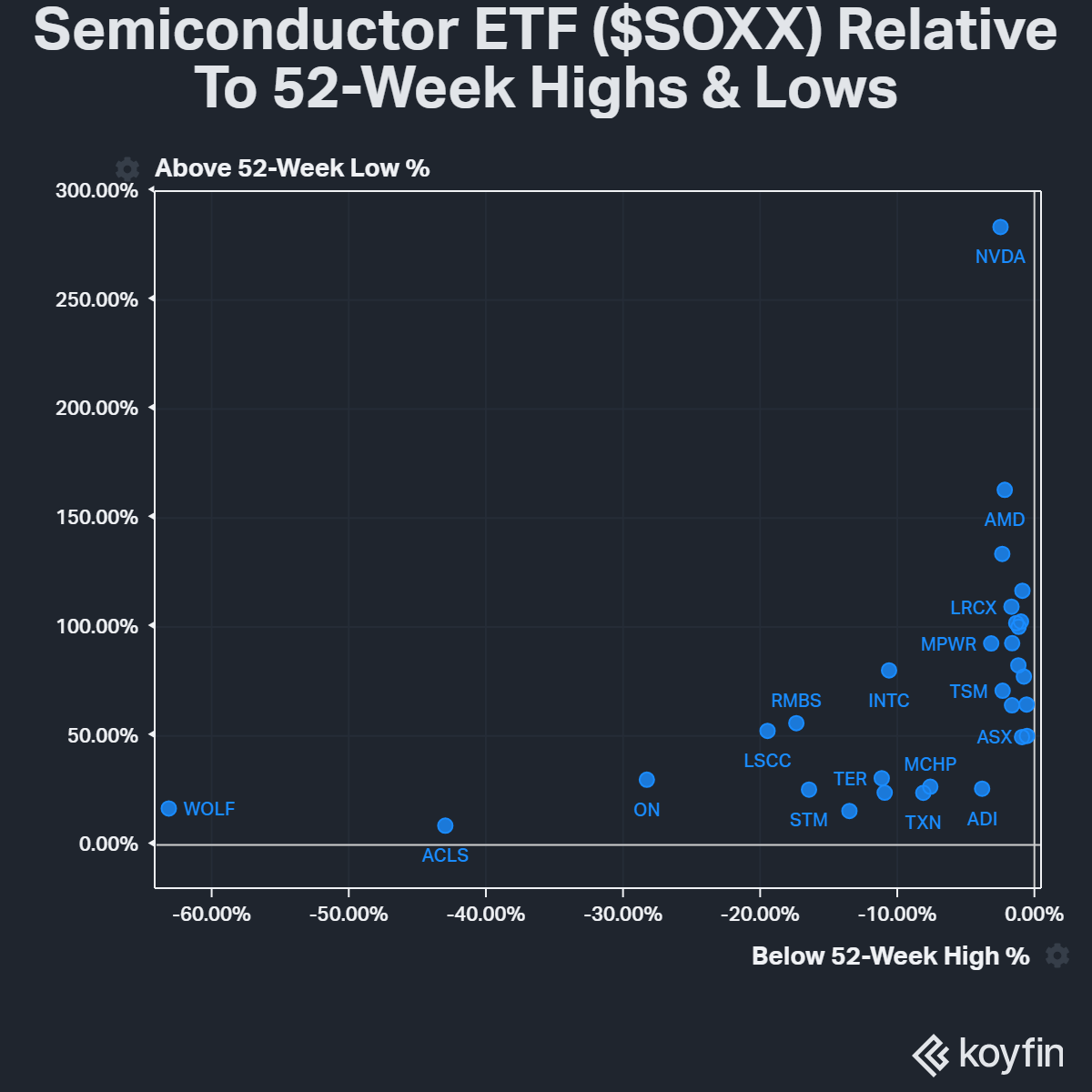

To provide some perspective on how crazy the move in this sector has been (as well as outliers in the group), below is a chart of $SOXX ETF components plotted vs. their 52-week highs and lows. 😮

On the upside, we obviously see major winners like Nvidia, AMD, Broadcom, etc., all up triple digits from their 52-week lows and sitting just below their 52-week highs. This is clearly where the momentum is, as investors begin to spread their money around to stocks that haven’t rallied as much yet. A great example is Taiwan Semiconductor, which has already started to play catch up. 👍

On the downside, it’s clear which stocks are not getting any love. Names like Wolfspeed, Axcelis Technologies, and even ON Semiconductor failing to gain traction with the overall market. 👎

The big question now is whether these laggards will eventually catch a bid or if money will continue to pile into the biggest winners in the sector. Those who have been betting on a catchup have been punished for that approach, so we’ll have to see if that changes in the days and weeks ahead. 🤷