While everyone is looking at the S&P 500 closing above 5,000 as this week’s stat of the week, MarketWatch is flagging another wild data point. 🚨

As you can see from the headline snippet above, Nvidia is now worth as much as the entire Chinese stock market. While several stocks already have achieved this feat, they’re bigger conglomerates with many businesses under one roof. But Nvidia is a chip designer and manufacturer with a more straightforward business model, making this that much crazier of an occurrence.

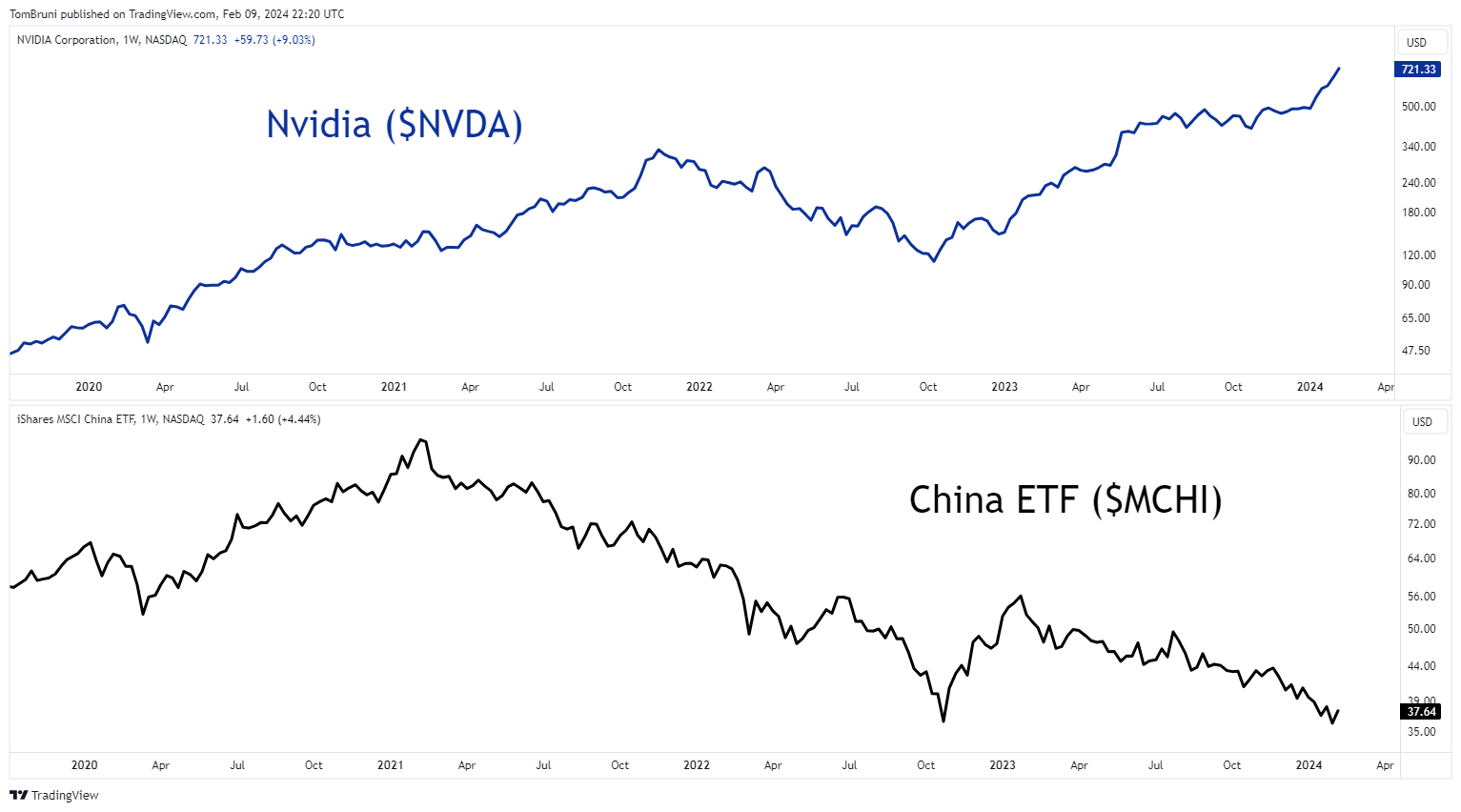

This doesn’t come as a massive surprise to anyone watching the action recently. Over the last five years, Nvidia’s stock price has soared while China’s stock market has more or less been left for dead.

The recent acceleration of these trends has many asking whether the semiconductor optimism and Chinese economy/market pessimism have gotten ahead of themselves. 🤔

We’ll have to wait and see what the coming months bring, but it’s an amazing stat that sums up market sentiment better than anything else. 🤯