One of the key themes we discussed last year was the underperformance of Chinese stocks. While India and other emerging markets rallied sharply (along with the rest of the world), China’s stock market was stuck in the mud because of slowing growth, weak consumer spending, a property market crisis, and geopolitical tensions. ⚠️

Unfortunately for emerging market investors, none of those core issues have improved in 2024, leading its stock market to fall even further to start the year. 😬

Below is a monthly chart of the popular Hang Seng Index. As we can see, prices are approaching their late 2022 lows while most other indexes around the globe are well above theirs. More broadly, prices are back to roughly the same levels they were at in the late 1990s, showing a distinctive lack of progress over the last two decades. 😞

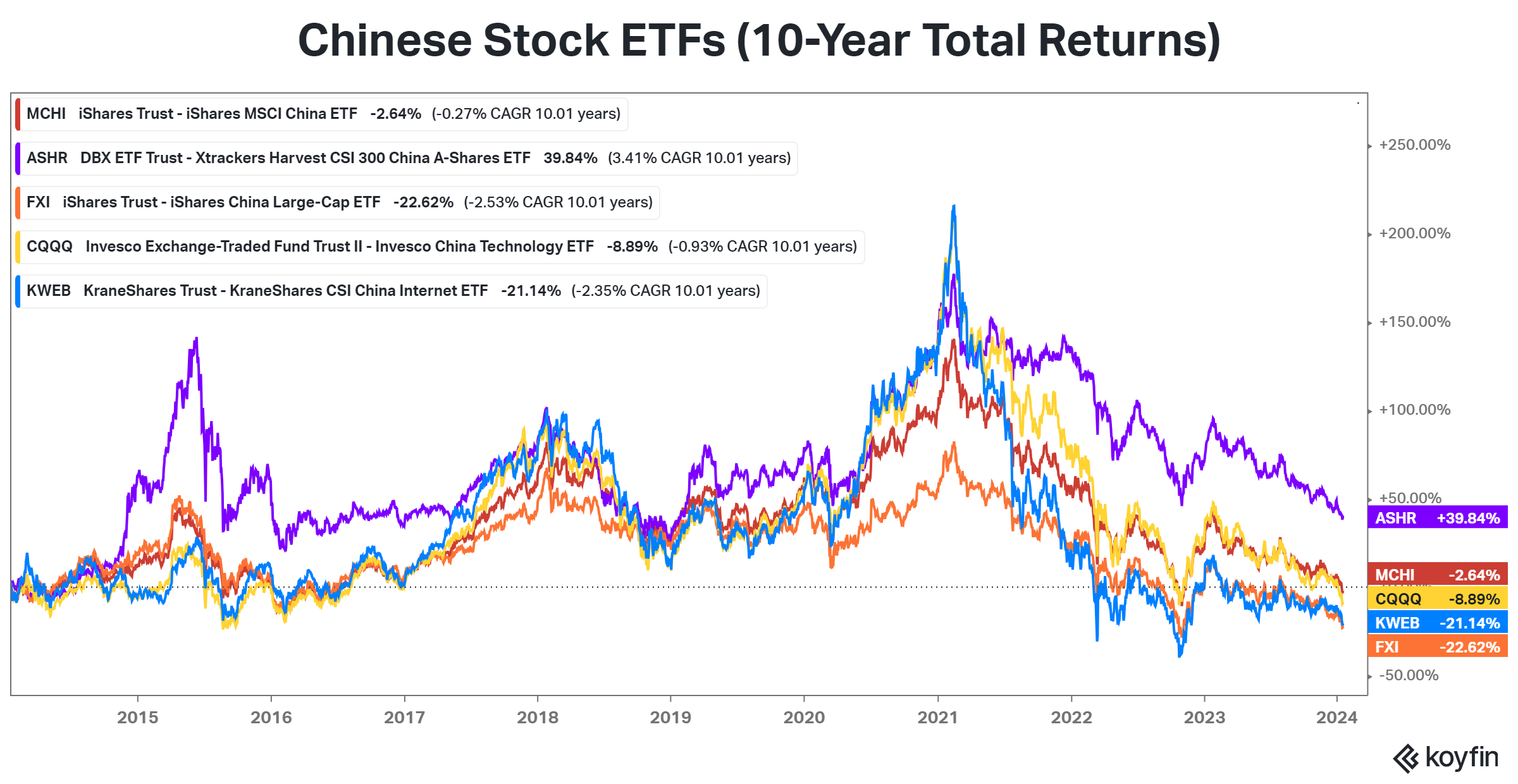

Many investors have raised concerns about China’s stock market and its ability to deliver adequate returns to investors. In addition to the headwinds discussed above, the fact that many major companies are state-owned instead of private enterprises presents a significant challenge for investors in capturing their share of economic progress. 💸

As a result, we’ve seen many ETF providers begin to create emerging market products that exclude China, or at least those entities that are state-owned enterprises.

The consensus on Wall Street is that China’s lackluster performance will continue. With other markets performing significantly better over the last year and mainstream China-focused ETFs providing almost no returns over the last decade, investors are simply looking elsewhere. Time will tell if the naysayers are wrong in their view, but for now, the market has proven them right. 🤷