As we’ve been highlighting for a long time, investors and traders continue to seek opportunities in the micro and small-cap healthcare space in hopes of a buyout.

With the most prominent players sitting on tons of cash and needing their next growth driver, it seems like there’s a new company being acquired every day. 🤑

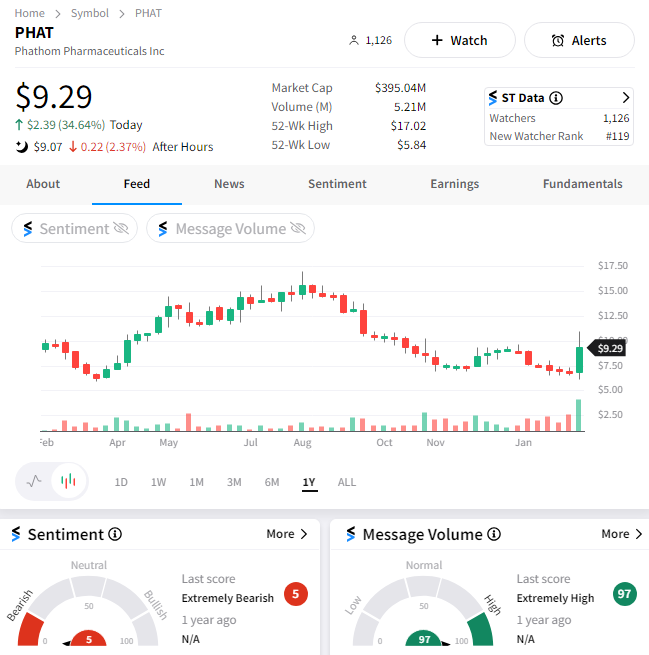

That’s why stocks like Phathom Pharma can rise sharply on seemingly no news. 🤷

However, investors who prefer a more diversified approach to the biotech sector are finding opportunities in ETFs like XBI. 🧺

Stocktwits user Christopher Brecher shared the chart below showing the S&P Biotech ETF pushing toward the top of a two-year trading range. He points out that a successful breakout through the mid-90s would target the mid-120s over the medium to long term, representing 30% upside.

With the market indexes and healthcare sector ETF $XLV hitting all-time highs, bulls say now is the time for $XBI and other laggards to play catchup. Time will tell if they’re correct, but the healthcare sector and its many industries are a key focus area for investors and traders right now. 🕵️♂️