When the Department of Justice successfully blocked the merger of JetBlue and Spirit Airlines earlier this week, we knew it would be an ongoing story. However, very few people saw it taking the turn it did today, with Dave Portnoy (aka “Davey Day Trader”) emerging from the shadows and rallying fellow retail traders behind the company.

Let’s see what happened. 👀

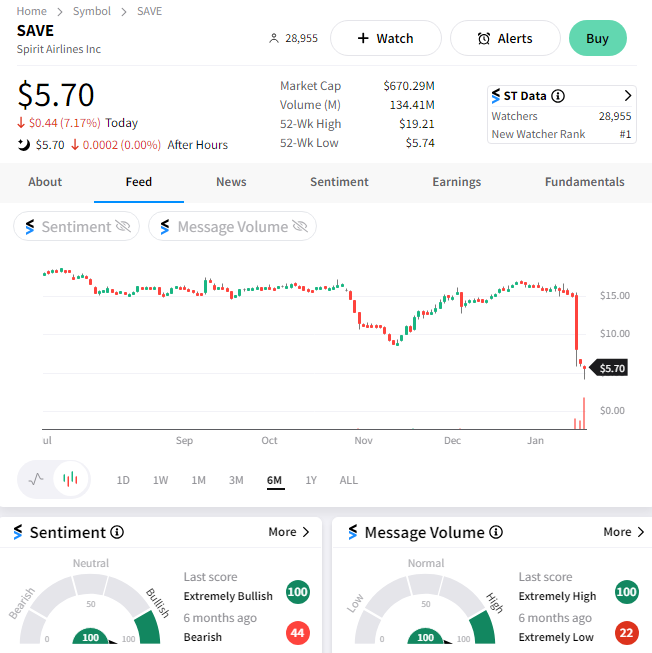

As we discussed on Tuesday, Spirit Airlines’ shares plummeted nearly 50% when the deal was blocked for being anti-competitive. Since then, they’ve been melting their way lower as investors (and the company) assess the best path forward for the struggling airline. 📉

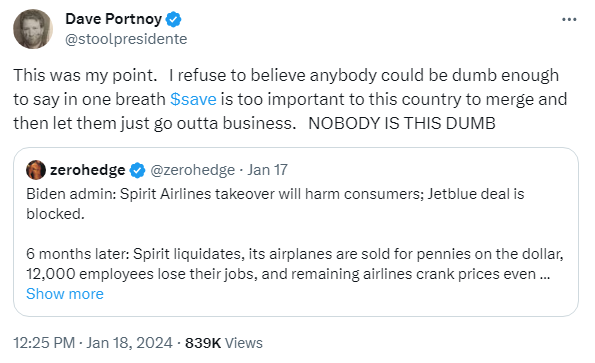

Overall, many people were confused about the logic of this decision by the Biden administration. On the one hand, the judge said Spirit Airlines was too important to the country’s consumers to allow it to merge. Yet the decision to block the merger cratered the stock and left it in a very vulnerable position. Those two things seem to be at odds with each other. 🤔

And Dave Portnoy thought so, too, as shown by his tweet this afternoon.

With that said, Dave’s re-emergence as stock trader extraordinaire would not be complete without some comedic timing. Roughly two minutes after Dave published this article outlining his reasoning for buying “a ton” of Spirit Airlines stock, the shares fell sharply.

Reports from The Wall Street Journal indicated the airline was exploring restructuring options, though management later denied that.

Despite the rough entry into the stock, Portnoy was not discouraged. Instead, he took to X to reiterate his thesis in an erratically entertaining fashion, at one point saying that #DDTG Global placed a “mega buy” on the stock. 🐂

Whether driven by his activity or not, some investors rallied behind the idea and helped Spirit Airlines’ shares claw back to their opening price. If the high volatility and fanfare around the stock continue, it has the potential to become a “meme stock,” just like other struggling companies did back in the days of the pandemic.

We’ll have to see how this story develops in the coming days. But for now, the Stocktwits community is bulled up with activity around the stock jumping sharply. It was the number one stock on the platform today in terms of new watchers. 📈

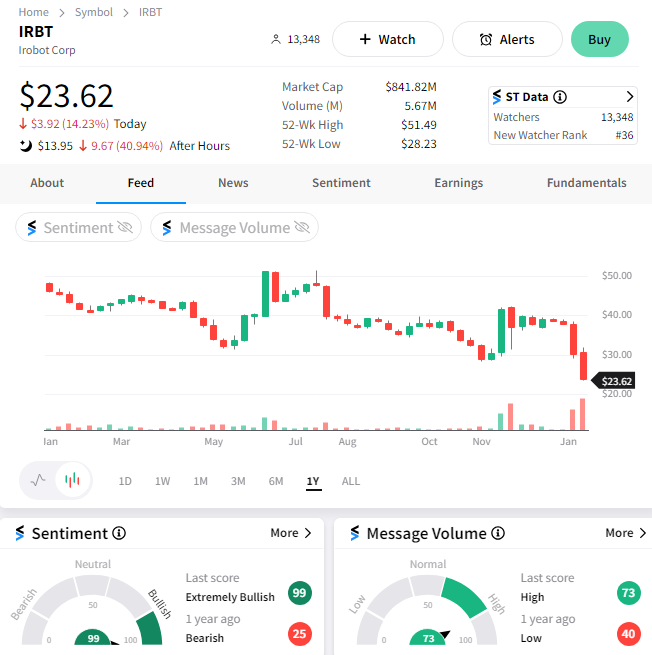

Lastly, it’s worth noting that Spirit Airlines isn’t the only stock being destroyed by anti-competition regulators this week. 😮

$IRBT shares cratered to 11-year lows following news that the European Union’s competition watchdog intends to block Amazon’s $1.7 billion bid. The rumor comes after the tech giant failed to make concessions to appease the regulator. 👎

Whether or not the retail investing community can come to their rescue remains to be seen. Either way, get the popcorn ready because it’s bound to be a story worth watching. 🍿