Advertisement. Remove ads.

‘Digital Nomad’ Hospitality Chain’s Stock Grabs Most Retail Attention This Week — But Not For The Right Reasons

Gen-Z and millennial-focused hospitality chain Selina Hospitality PLC (SLNA) has captured the attention of retail investors this week, albeit under unfortunate circumstances.

The company filed for insolvency on Monday, stating it has no reasonable prospects of avoiding bankruptcy, and is likely to be delisted from the Nasdaq.

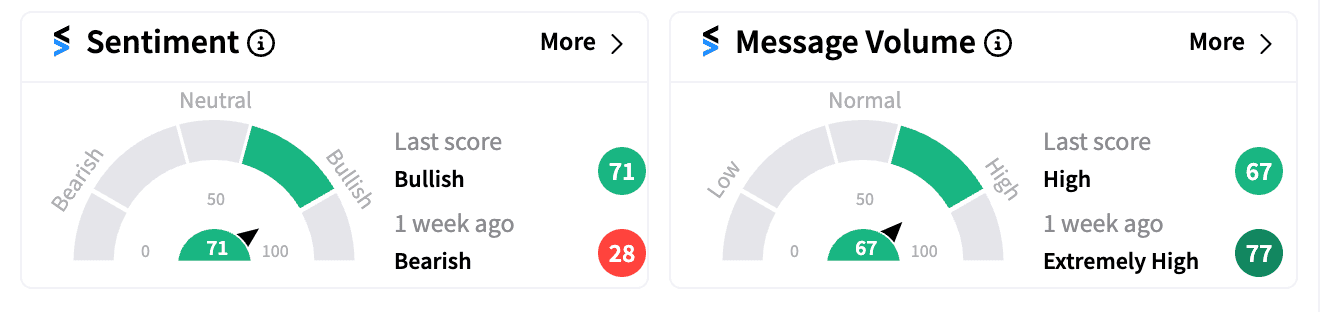

Amid the grim news, retail investor interest in Selina has surged. Stocktwits data reveals a 15% increase in the company's following and a staggering 1,900% spike in message volume over the past seven days.

Interestingly, retail sentiment on Selina turned surprisingly bullish on Friday afternoon, even as the stock crashed over 11% to $0.0329. Some traders are looking for a potential "squeeze" or short-term bounce following the slew of bad news and sharp price decline, helping push sentiment back into bullish territory from a "bearish" zone a week ago.

Selina, known for its co-working spaces and experiential programming targeting “digital nomads,” launched in 2014 and went public via a SPAC merger in 2022 with a $1.20 billion valuation.

However, the company has lost nearly all of its value since then and has struggled financially, reporting a total revenue of $201 million for 2023 with an occupancy rate of 52.30%.

Selina's insolvency filing was triggered by its inability to repay IDB Invest a $50 million loan, including a missed interest payment of $455,000.

The company has appointed joint administrators from FTI Consulting to explore options, including a potential sale of its assets.

Selina earlier touted itself as the “world’s largest hospitality brand” with close to 30,000 beds across Australia, the U.S., Mexico, the U.K., South America, Portugal, Morocco and Thailand. Now, its future remains uncertain as it navigates the complexities of insolvency. It most certainly has retail investors’ attention.

Photo via Vecteezy

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/01/piramal-aranya-arav-2025-01-9ca6001c2614d6f431d1dde76b7bdeeb.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/08/adani.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/09/img-20250906-wa0020-2025-09-5eb06bd17ff7f09275c65cf5224cebaf.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/03/cars-auto-sales-trade-2025-03-112a2d39607959bc768b9aab6126e355.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228106047_jpg_9b9a5ca202.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/02/anand-singha-thumnails-90-2025-02-69074ef2fa5040cebb8fe5d51a8f98e4.jpg)