Advertisement|Remove ads.

Nykaa Shares Hit Fresh 52-Week High; Orchid Research Pegs Support At ₹226

Shares of FSN E-Commerce Ventures, the parent company of Nykaa, have gained 6% in two sessions after the Falguni Nayar-founded e-commerce giant reported ‘healthy performance’ in its second-quarter business update earlier this week. The company expects its consolidated net revenue growth to be in the mid-20s in the second quarter compared to the same period last year, driven by the festive season.

In an exchange filing released in the post-market hours, Nykaa said that it expects its consolidated Gross Merchandise Value (GMV) to be close to the thirties in the July-August quarter of the financial year 2026, as against the mid twenties in the last few quarters. "This superior performance is driven by renewed growth in the Fashion vertical and healthy performance of Beauty vertical," it said.

Nykaa anticipates its beauty segment will achieve mid-twenties growth in net sales value (NSV) and revenue, marking its tenth consecutive quarter of such performance. Acquired brands like Dot & Key and its proprietary brands, including Kay Beauty and Nykaa Cosmetics, are expected to drive this growth.

Technical Outlook

SEBI-registered analyst Orchid Research noted that Nykaa tested a 52-week high again on Tuesday, driven by strong momentum. The stock recently broke through key resistance levels, as indicated by an ascending wedge pattern on the daily chart, and is soaring higher.

They expect the upcoming festive and wedding season to boost demand for Nykaa. As both Dussehra and Diwali fall in October this year, November will not feature any major festivals. Consequently, Orchid Research expects a rise in consumer spending for the wedding season.

On the technical front, they expect Nykaa stock to continue its upward momentum until a break of the structure near ₹226 (acting as a stop-loss) is observed.

Analyst Akhilesh Jat highlighted that Nykaa had formed a rounding bottom pattern with key resistance at ₹230. The stock successfully broke above this level last week and is now trading firmly above its 50, 100, and 200-day Simple Moving Averages (SMAs), which is a strong bullish signal. With a favorable technical setup and improving fundamentals, Nykaa appears to have entered a fresh uptrend. Jat added that is the stock holds momentum above ₹250, it could open further upside in the near term.

What Is The Retail Mood?

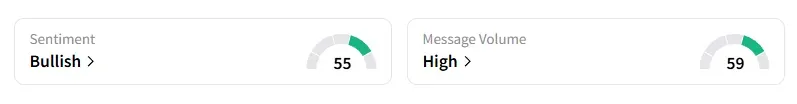

Data on Stocktwits shows that retail sentiment has been ‘bullish’ for a week amid ‘high’ message volumes.

Nykaa shares have surged nearly 60% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_vlad_tenev_robinhood_CEO_OG_jpg_bf3a4c4bee.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2071907975_jpg_85e059f13e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_medline_jpg_51082f0148.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_dbv_tech_jpg_6fddcbe1e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_waymo_jpg_4a90f6626f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_netflix_paramount_warner_bros_jpg_c959c8a9e4.webp)