Advertisement|Remove ads.

Tesla Stock Revs Up Amid US Election Uncertainty, While Rivian And Lucid Lag Ahead Of Earnings: Retail Sees Green

Tesla Inc. ($TSLA) stock gained nearly 4% on Tuesday afternoon, just hours ahead of a possible outcome for the 2024 U.S. presidential election, with some retail investors expecting a victory for Republican nominee Donald Trump.

Meanwhile, Rivian Automotive Inc. ($RIVN) and Lucid Group Inc. ($LCID) remained flat ahead of their earnings on Thursday, weighed down by broader market concerns on how election results may impact policy for the electric vehicle industry.

Some Wall Street analysts worry that a Trump victory could negatively impact the sector, as they believe he could make it tougher for such vehicles to qualify for tax credits based on where they source their components from.

“If Trump gets into the White House he clearly would have a harsher stance on China around tariffs and trade policy,” said Wedbush analyst Daniel Ives in a research note on Sunday.

This scenario could lead to trade tensions and geopolitical challenges for Tesla in one of its key markets that will be viewed negatively by Wall Street.

However, the brokerage also noted that a Trump victory could provide Tesla with a competitive advantage in a market without EV subsidies and increased tariffs on Chinese imports may further limit the influx of cheaper EVs into the U.S. market.

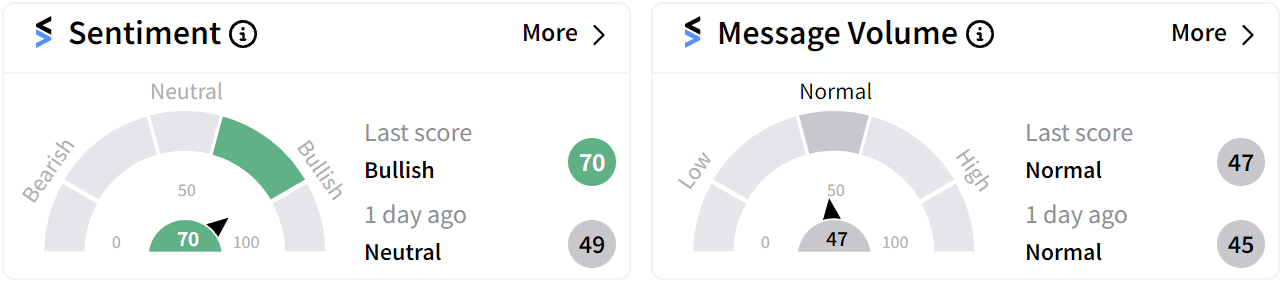

Retail sentiment around Tesla on Stocktwits has jumped into ‘bullish’ territory (70/100) as the 2024 U.S. Election kicked off with a majority of retail investors on the platform expecting a Trump victory.

Even if Trump loses, Tesla still stands to benefit. Analysts expect that a Democratic administration under Kamala Harris would likely maintain or even increase EV tax credits as part of a strong push to accelerate EV adoption among U.S. consumers.

The incentives, along with policy focus on reducing emissions, would align with the company’s long-term growth goals, keeping it in a favorable position in the EV market.

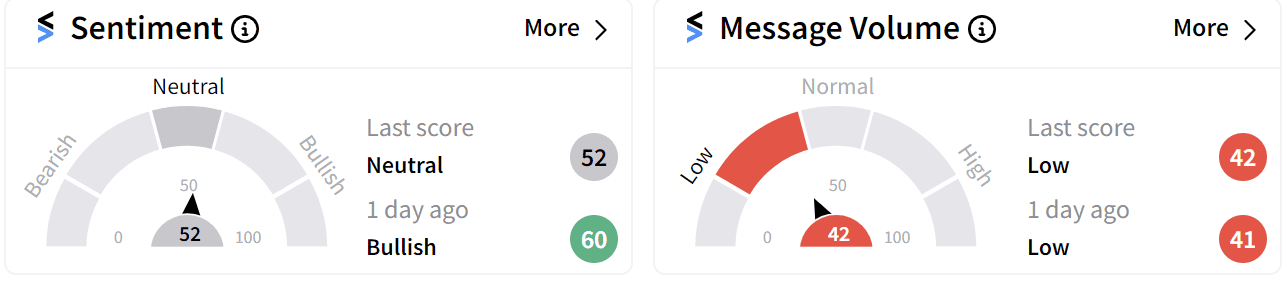

On Stocktwits, retail sentiment for Rivian has shifted to a ‘neutral’ stance (52/100), with users divided over whether a Trump or Harris administration would better support the company’s long-term growth.

Rivian is scheduled to report its third quarter earnings on Thursday with Wall Street expecting earnings per share (EPS) of $0.94 on revenue of $1 billion. The company has missed estimates for the last three quarters.

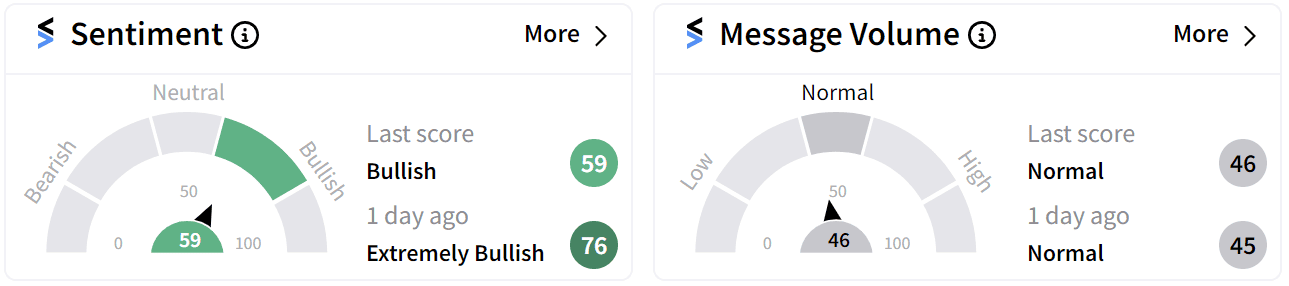

Retail sentiment for Lucid has eased into ‘bullish’ (59/100) territory on Stocktwits, with users split but largely optimistic about a potential earnings beat in Thursday’s report.

Tesla is the only one of the three stocks to have gained in 2024, rising 2% so far. By contrast, Rivian's stock has declined 51% this year, while Lucid is down 46%.

For updates and corrections email newsroom@stocktwits.com.

Read more: Marqeta Stock Tanks 40% On Lowered Revenue Outlook, But Retail Sentiment Defies Wall Street Doubts

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2215390052_jpg_84ddd1faac.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Core_Civic_resized_jpg_120d89cac4.webp)