Advertisement|Remove ads.

Bitcoin Stuck Below $70K: Analyst Willy Woo Warns Bear Phase May Not Be Over Yet

- Bitcoin remains under pressure, with an analyst noting rising volatility.

- Retail sentiment remained in the ‘bearish’ zone on Stocktwits, as Bitcoin struggled near $68,000.

- Ethereum, Dogecoin, Binance Coin, and XRP all saw daily gains, while Solana remained in the negative territory.

As Bitcoin struggled to cross the $70,000 mark on Wednesday, analyst Willy Woo noted that trend risk remains skewed downward.

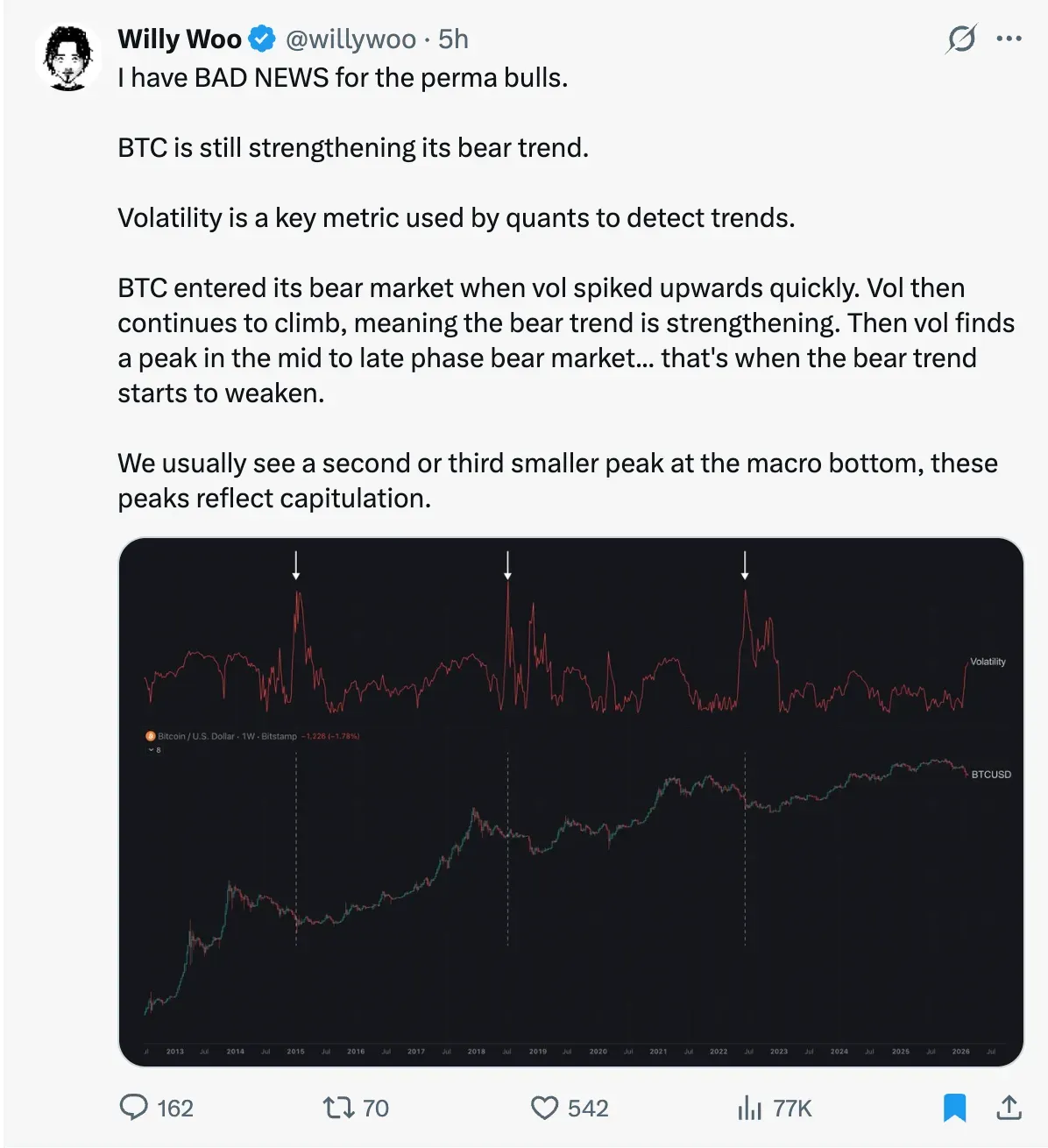

According to Willy Woo, Bitcoin is still in a bear-phase regime, with volatility increasing rather than contracting. This pattern is typically associated with trend continuation rather than with long-lasting bottoms. This does not appear to be a confirmed bottom, but rather a consolidation within weakness.

Based on current volatility patterns, the analyst noted that Bitcoin has not yet reached the late-cycle "capitulation peak," which typically signals the end of a trend. Bear trends only became weaker after volatility peaked and rolled over in previous cycles.

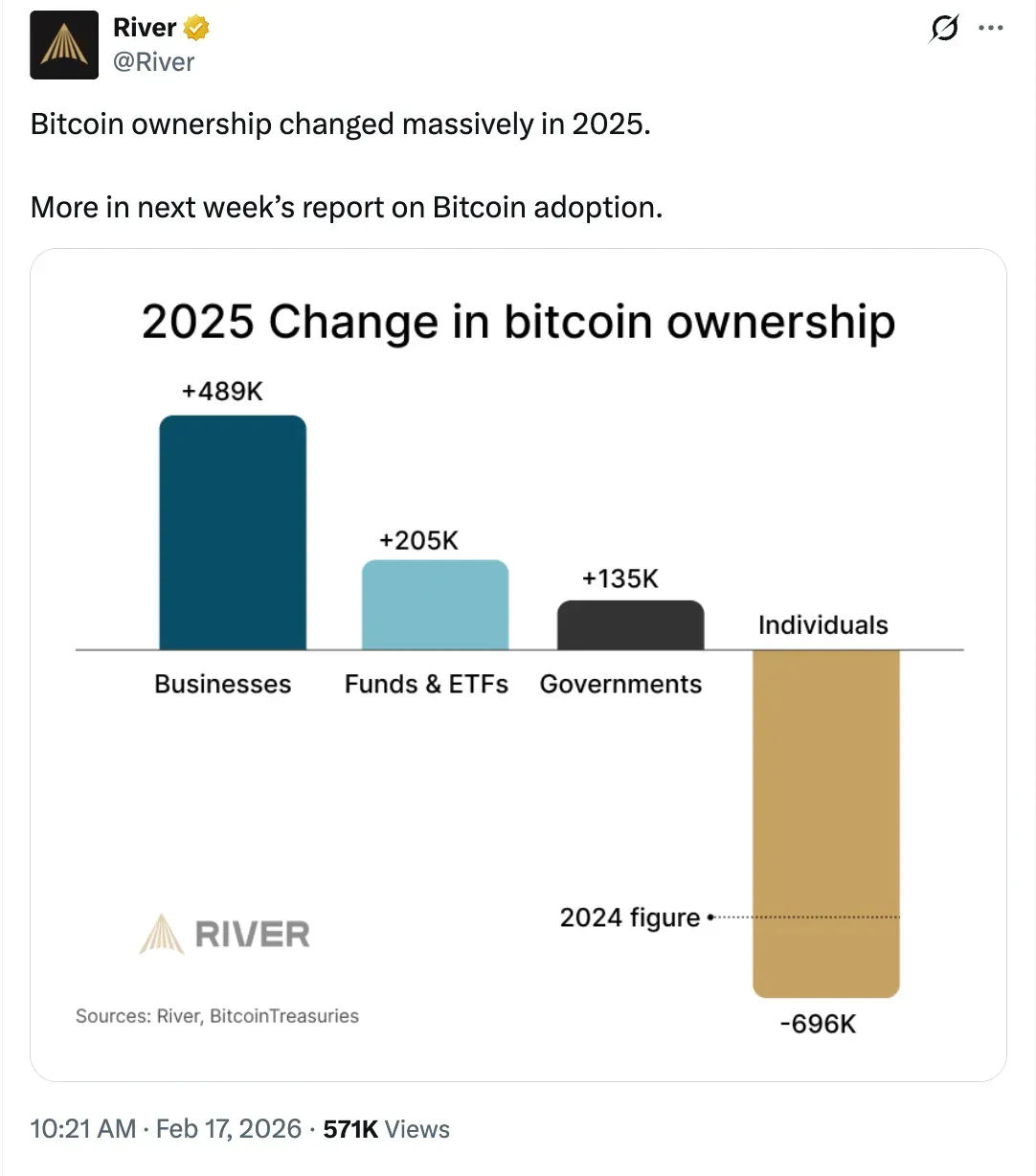

Woo said that macro bottoms usually follow many smaller volatility spikes, indicating that retail is capitulating. This means that any bounce in the near future may only be temporary. In 2025, Bitcoin ownership changed massively, with retail traders struggling to enter, as businesses, funds, ETFs, and governments continued to buy, according to River.

Kyle Doops, a technical analyst at Crypto Banter, noted that Bitcoin open interest has declined 55% from its all-time high. This is the biggest drop since April 2023. There is still no confirmation of the trend, but speculation has cooled. The Inter-Exchange Flow Pulse (IFP) is still in a bearish zone. But the rate of deterioration is leveling off, which could be an early sign that selling pressure is slowing down, but it is not yet a confirmed reversal.

Bitcoin (BTC) traded at $67,968.96, up by 0.1%, and saw about $69.88 million in total liquidations over the past 24 hours. On Stocktwits, the retail sentiment around Bitcoin remained in ‘bearish’ territory, with chatter at ‘low’ levels in the past day.

Altcoins See Mixed Performance As Sell Pressure Reaches 5-Year High

According to CryptoQuant data, altcoin sell pressure has reached a multi-year extreme, with 13 consecutive months of net selling on centralized exchanges, marking a five-year high.

Ethereum (ETH) traded at $2,005.08, up by 2.1%, with a total liquidation of about $52.12 million in the past 24 hours. On Stocktwits, the retail sentiment around Ethereum remained in ‘bearish’ territory, with chatter at ‘low’ levels in the past day.

Solana (SOL) traded at $84.90, down by 0.1% in the past 24 hours. The token saw around $7.44 million in total liquidations in the past 24 hours. On Stocktwits, the retail sentiment around Solana remained in ‘bearish’ territory, while chatter decreased from ‘normal’ to ‘low’ levels in the past day.

Ripple’s XRP (XRP), trading at $1.48, went up by 1.7% with about $5.78 million in total liquidations in the past 24 hours. On Stocktwits, the retail sentiment on XRP remained in ‘bearish’ territory as the chatter went down from ‘normal’ to a ‘low’ level in the past day.

Binance Coin (BNB) traded at $619.15, up by 0.6%, as it saw total liquidations of about $343,230 in the past 24 hours. On Stocktwits, the retail sentiment around BNB improved from ‘neutral’ to ‘bullish’ territory even though the chatter went down from ‘normal’ to ‘low’ levels in the past day.

Dogecoin (DOGE), trading at $0.1003, rose 1.7% over the last 24 hours, with about $3.42 million in total liquidations. On Stocktwits, the retail sentiment around DOGE remained in ‘bullish’ territory with chatter at ‘extremely high’ levels in the past day.

Cardano (ADA) traded at $0.283, up by 1.2% in the past 24 hours. The token saw total liquidations of about $352,540 in the last 24 hours. On Stocktwits, the retail sentiment around Cardano remained in ‘bullish’ territory with chatter at ‘normal’ levels in the past day.

Read also: Hedge Fund Jane Street Raised BlackRock’s IBIT Holdings To $790 Million

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_arthur_hayes_OG_jpg_734ff95af6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_parazero_technologies_drone_representative_resized_f67140d5c3.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_jim_cramer_OG_2_jpg_b3d8e3bbe7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_upwork_jpg_f9d5e591d5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2248926041_jpg_87d77606e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rare_Earth_resized_jpg_e635892f59.webp)