Advertisement|Remove ads.

Bitcoin Slips Below $112,000 — Gold Bull Peter Schiff Warns Of ‘Rude Awakening’ For Investors

Bitcoin and other major cryptocurrencies slipped in early trading, alongside global equities, on Tuesday, as concerns grew over the ongoing trade tensions between the U.S. and China.

The apex cryptocurrency was down over 3% at $111,688.14 at the time of writing, as per CoinMarketCap data. Ethereum slipped over 4% to $3,982.13, XRP dipped 6.6% to $2.45, while BNB plunged 10.9% to $3,982.13 after scaling to an all-time high after a report said that a Chinese investment bank is looking to set up a $600 million BNB treasury. Among other tokens, Solana fell 1.3% and Dogecoin dropped 5.6%.

According to a Reuters News report, China's commerce ministry said on Tuesday the U.S. cannot seek trade talks while also making threats, raising concerns about whether the two sides will be able to strike a trade deal.

On Monday, Treasury Secretary Scott Bessent said that the meeting between U.S. President Donald Trump and his Chinese counterpart, Xi Jinping, is still likely to take place later this month, which helped in a rebound in global equities. However, later he accused Beijing of trying to harm the global economy. Additionally, China and the U.S. will each levy an additional charge on ships from the other country.

Investor Ted Pillows noted that the next support level for Bitcoin is the $110,000 to $111,000 level. “If Bitcoin holds this level, we could see a bounce back. Otherwise, a sweep of the $107,000 support level before reversal could happen,” he said.

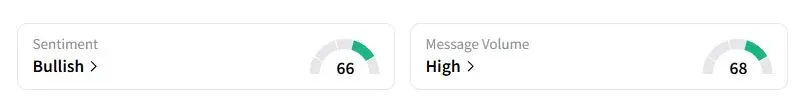

Retail sentiment on Stocktwits about Bitcoin was in the ‘bullish’ territory at the time of writing.

Investors In For Rude Awakening, Schiff Warns Again

Notable crypto skeptic and gold bull Peter Schiff had a warning for crypto investors. Comparing the moves of precious metals with digital currencies, Schiff warned that crypto buyers are in for a “rude awakening” and will soon learn a “very valuable but expensive lesson.” He added that the Friday Bitcoin “flash crash wasn’t a buying opportunity but a warning.”

However, according to a CoinPedia report, investor Mark Yusko said that any future declines in the most valuable cryptocurrency will be less damaging than past cycles. He reportedly said that earlier bear markets saw drops of more than 70%, but this time he expects the next one to be much smaller, likely between 15% and 20%.

Also See: JPMorgan Q3 Earnings On Deck: Retail Traders See Profit Beat, Eye Credit Trends Closely

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786706_jpg_5f9940e890.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)