Advertisement|Remove ads.

Why Japan’s Bond Moves Matter More Than Crypto Sentiment For Investors Now

- Bitcoin’s weakness versus gold may have less to do with crypto sentiment and more to do with Japan.

- For global markets and US risk assets in particular, BOJ intervention has historically acted as a liquidity release valve.

- While some analysts are bullish on Bitcoin, saying it's a matter of time before BTC moves higher, others are betting on gold.

Gold’s (XAU) rally and Bitcoin’s (BTC) underperformance in early 2026 are converging on an unlikely catalyst: Japan’s bond market. A sharp rise in Japanese bond yields is reshaping risk signals, providing a booster for gold, while leaving Bitcoin in a wait-and-watch mode ahead of potential intervention from the Bank of Japan (BoJ).

On Friday, Japan's 2-year government bond yield hit a record high of 1.245%, a level not seen since 1996. Meanwhile, Japan’s 10-year government bond yield has steadied at 2.25%, indicating long-term upward pressure persists. Market participants argue that this could be a new shift in how investors gauge risk.

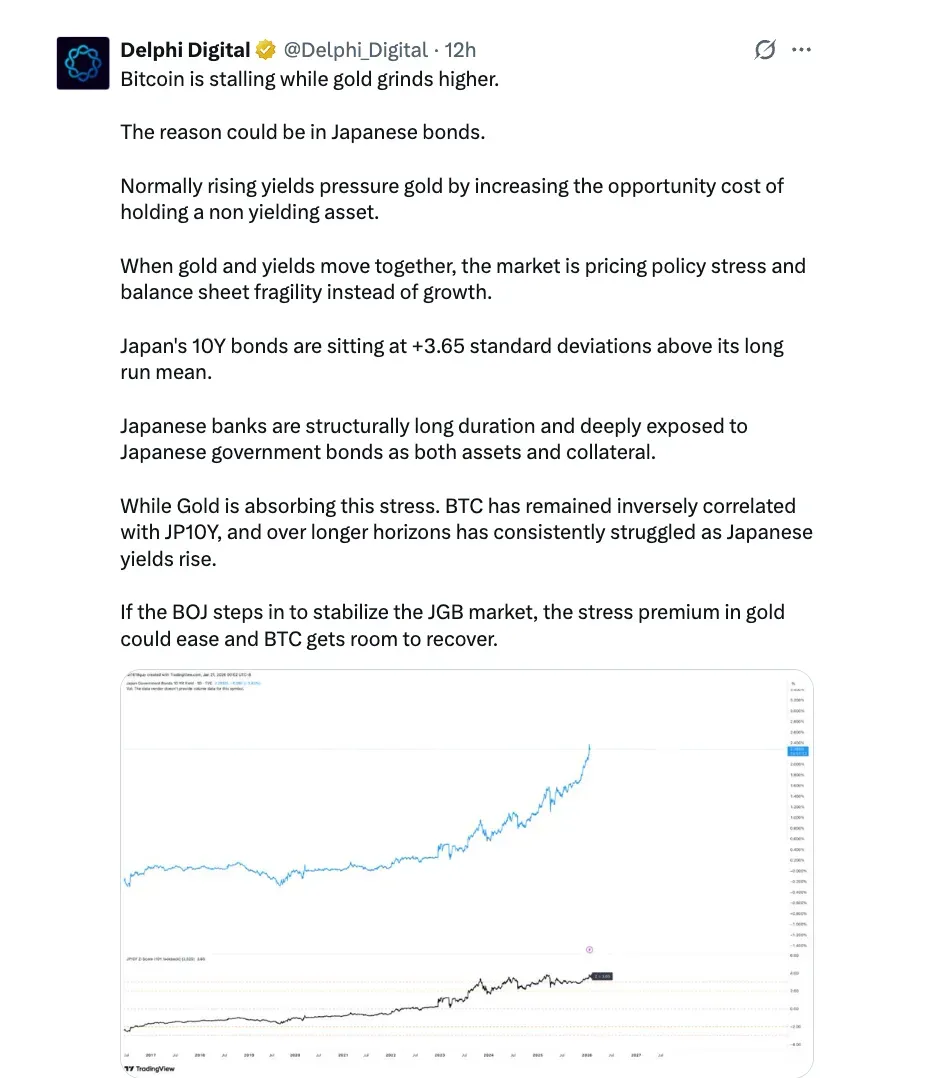

Japan’s Yield Shock Rewrites The Gold–Bitcoin Playbook

A Delphi market researcher, Marcus, said the surge in Japanese bond yields is no longer pressuring gold through higher opportunity costs, as theory would suggest. Instead, gold and Japanese bonds are now rising together, a shift he sees as a sign of policy stress and balance-sheet fragility, rather than ‘healthy normalization.’ He also pointed out that the one-year relationship between gold and JP10Y has now turned positive.

For global markets and US risk assets in particular, BOJ intervention has historically acted as a liquidity release valve.

When or if the BOJ intervenes credibly, either by smoothening the yield-curve or regaining its control over the long-end of the curve, liquidity would equalize, and Bitcoin historically reacts more positively to BOJ interventions than gold itself. This is why the macro researcher believes that bitcoin is not competing with gold during times of stress but rather waiting for the BOJ to turn off the “stress signal”.

Bitcoin was trading at $89,418, down 0.5% over the last 24 hours. On Stocktwits, retail sentiment around Bitcoin remained in ‘bearish’ territory, as chatter remained at ‘normal’ levels over the past day.

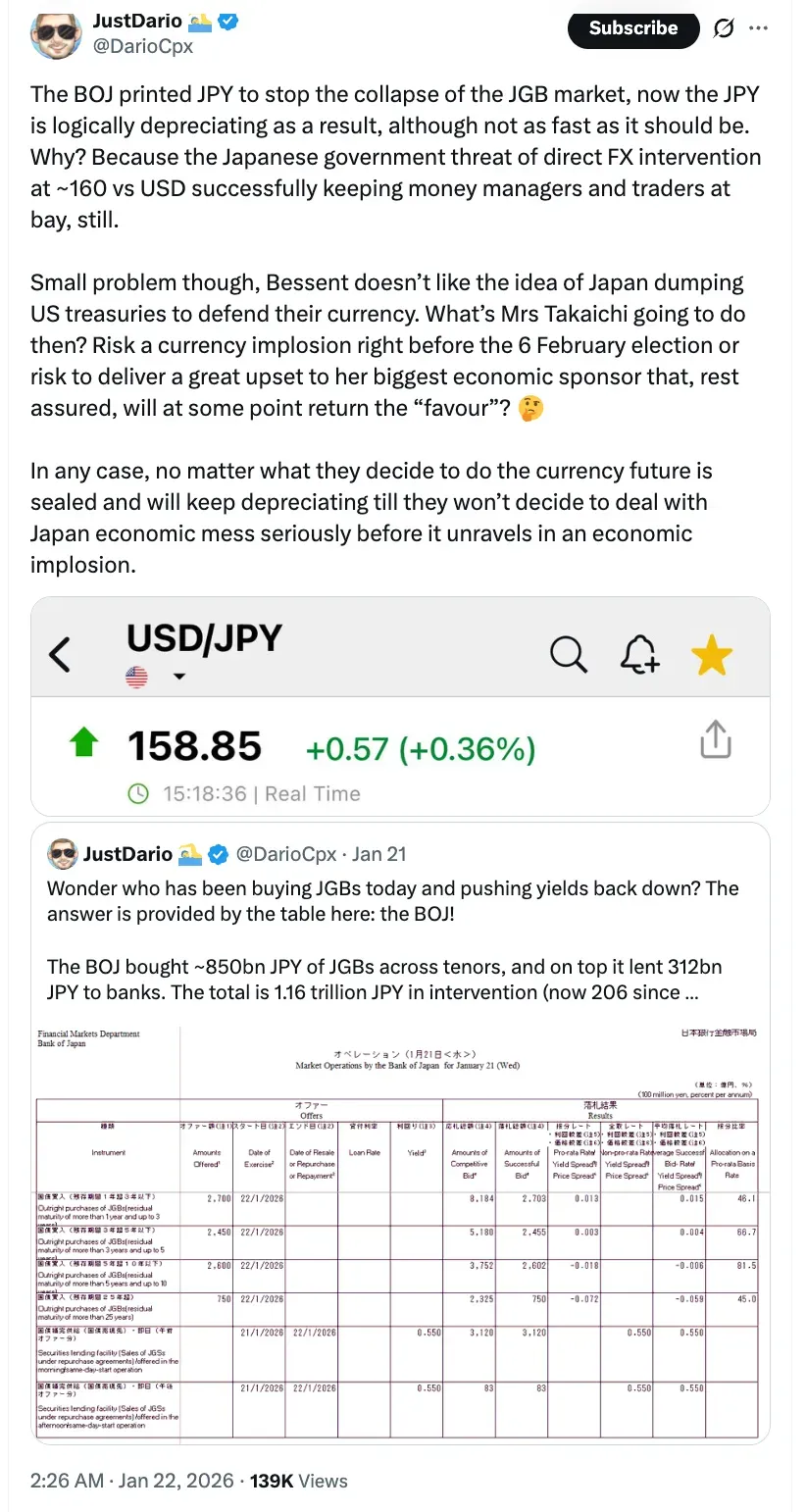

BOJ Intervention Becomes The Liquidity Catalyst To Watch

In contrast, macro trader JustDario said the BOJ has already been compared to intervening to de-escalate the situation in the Japanese government bond market. In a single session, the BOJ provided around ¥1.16 trillion in liquidity support by purchasing eight ¥50 billion in government bonds, while lending ¥312 billion to banks. He stated that this has effectively put pressure on the currency, and the yen has depreciated to $158.8. In his opinion, such frequent short-term remedies push gold as a hedge, citing it as the reason for gold's edge higher.

Gold (XAU) was trading at $4,596.32 per ounce on early Friday. On Stocktwits, retail sentiment around gold-backed stablecoin Tether Gold (XAUT) remained in ‘neutral’ territory, with chatter at ‘high’ levels over the past day.

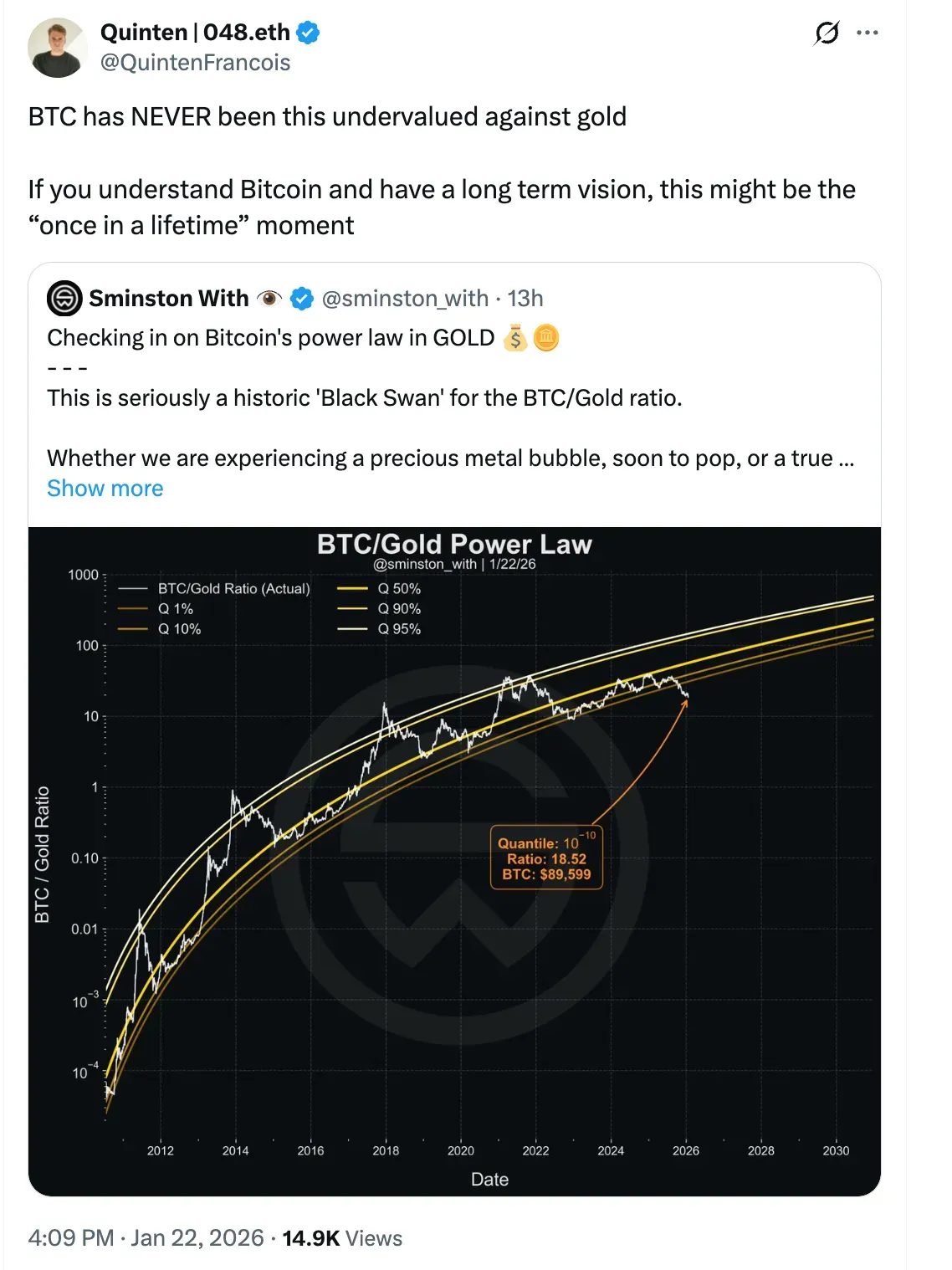

Analysts Frame Bitcoin As Long-Term Opportunity

In a similar vein, crypto analyst Quinten François said BTC has "never been this undervalued against gold "on a long-term basis. Referencing Bitcoin/gold power law models, he described the current ratio as a potential once-in-a-lifetime opportunity” for long investors who understand Bitcoin's economic model.

Mark Chadwick, another investor and market analyst, believes that gold’s rise is bullish for the crypto market. Once gold hits an all-time high, he added, Bitcoin follows the rally and altcoins trade higher. This was seen in both 2017 and 2021, Chadwick notes, when gold rallied 30%, Bitcoin was up 1900%, and altcoins edged higher, outperforming Bitcoin in 2021.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1959831267_jpg_c83b1e0d88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/moderna_hq_resized_jpg_97563ed423.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_WU_Western_Union_dc673aaa7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149589805_jpg_ceec7778b8.webp)