Advertisement|Remove ads.

High-Stakes Crypto Bill Has Washington’s Attention – ‘Stablecoin Senator’ Lummis Says CLARITY Act Is Crucial To ‘America’s Leadership’

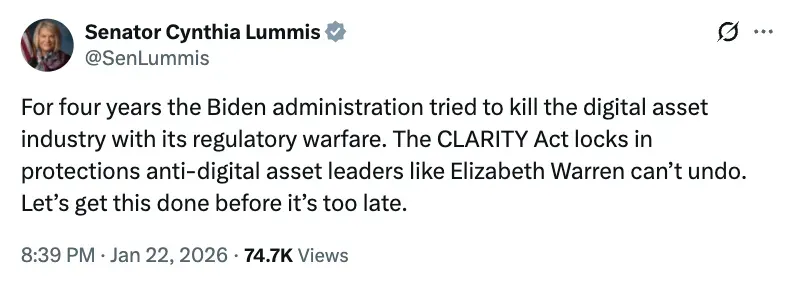

- Lummis criticized the Biden administration’s approach to digital asset regulation and said the CLARITY Act would establish protections that future administrations could not easily reverse.

- Senate lawmakers are advancing a narrower version of the CLARITY Act than the House, according to media mogul Paul Barron.

- In early January, Wyoming Senator Lummis introduced and authorized a state-led stablecoin called Frontier Stable Token or FRNT.

U.S. crypto regulation is back in focus as Senator Cynthia Lummis signals renewed momentum behind the CLARITY Act. Lummis said on Thursday that a new update to the much-awaited Act has renewed industry alignment, as lawmakers begin negotiating competing Senate and House visions for how U.S. digital asset markets should be governed.

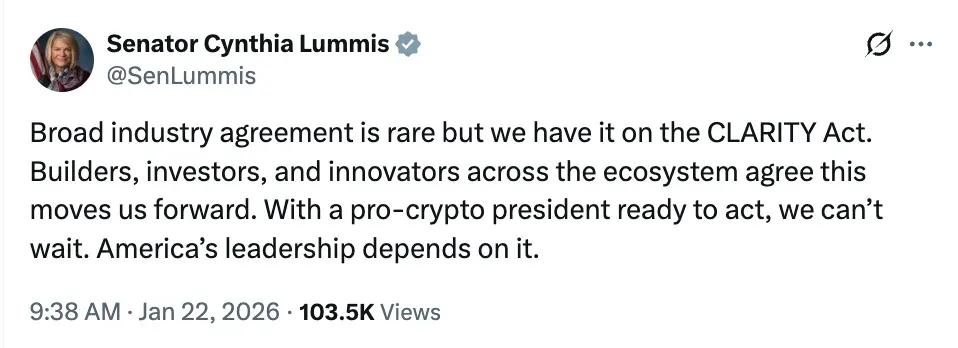

On X, the Wyoming Senator said builders, investors, and innovators across the digital asset ecosystem agree that the CLARITY Act would move the industry forward. Lummis noted that "broad industry agreement is rare, but we have it on the CLARITY Act.” She added that momentum has increased with a pro-crypto administration prepared to act, saying that “America’s leadership depends on it.”

Lummis expressed her support in subsequent posts, framing the market structure bill as a rare point of alignment across the crypto sector and urging lawmakers to act before the legislative window narrows. Lummis held the Biden administration accountable for stifling America’s regulatory approach to digital assets, saying the CLARITY Act would establish protection that future administrations could not easily reverse.

Previously, Lummis said the CLARITY Act brings together industry participants who want to move forward, adding that lawmakers now have both administrative support and legislative momentum to act.

Senator Lummis was the first US Senator to introduce and authorize the issuance of a state-led stablecoin, the Frontier Stable Token (FRNT), in early January. The stablecoin, running on Solana (SOL), is backed by both cash and short-term Treasuries. Franklin Templeton and Fiduciary Trust are currently serving as custodians for FRNT. On Stocktwits, retail sentiment around FRNT is in ‘Extremely Bullish’ territory, accompanied by ‘high’ chatter levels over the past day.

Senate Signals Tighter Oversight Than House Version

Lummis’s comments come as differences emerge between House and Senate approaches to the CLARITY Act.

The House-passed version of the CLARITY Act placed primary oversight of digital commodity markets under the CFTC, while maintaining the Securities and Exchange Commission (SEC) authority over digital assets classified as securities. It also set registration and disclosure requirements for crypto trading platforms and token issuers.

However, according to journalist and entrepreneur Paul Barron, the Senate has begun advancing its own version of the bill, positioning it as a counterweight to the House approach.

On Wednesday, Barron said on X that while the House proposal would grant the Commodity Futures Trading Commission (CFTC) broad authority over crypto markets, the Senate’s approach would narrow the scope of assets subject to regulation and impose strict customer-protection requirements.

He described the process as a “high-stakes negotiation” over how much discretion regulators should have and how tightly consumer safeguards should be defined.

Barron said the Senate agrees with a general direction of establishing a crypto market structure, but wants more precise limits and regulatory power. He added that the negotiations over the final rules are now beginning as lawmakers work to reconcile the two versions.

CLARITY Act: Next Steps?

The CLARITY Act is a proposed U.S. legislation intended to establish a federal framework for regulating digital assets. The bill seeks to clarify jurisdiction between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) by defining digital commodities and setting rules for how they are issued and traded.

The bill was expected to advance earlier this month, though no revised markup date has been announced yet. However, Chair Paul Atkins stated that he would be joining CFTC Chairman Mike Selig next week for a joint agency event to discuss harmonization between the SEC and the CFTC. Negotiations between the two chambers are now expected to determine the pace and final shape of U.S. crypto regulation.

Why It Matters For Investors?

The passage of the CLARITY Act would mark a turning point after years of confusion on crypto rules and regulations. Clearer regulation could make crypto markets more stable, reduce the risk of sudden lawsuits or bans, and encourage big financial firms to participate more openly. That said, the Senate’s tougher version of the bill could make it more expensive for smaller crypto companies to operate, which may favor larger, well-funded players while squeezing out weaker or riskier projects.

Read also: Ethereum Leads $197M Crypto Liquidation Wave As DC Regulatory Fog Spooks Traders

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786706_jpg_5f9940e890.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_resized_Mar_19_jpg_784f532fd2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243967992_jpg_33943df3b8.webp)