Advertisement|Remove ads.

Billion-Dollar Crypto Wipeouts Return

Crypto traders just spent a month playing chicken with leverage and the wreckage is easy to map.

The thirty-day liquidation chart reads like a seismograph that won’t stay quiet: green spikes on June 11-12 wiped roughly $600 million in long liquidation two days running as Bitcoin slipped under macro anxiety. A week later the Fed growled about rate path and another $900 million in longs went to money heaven.

By June 23 the crowd flipped short, only to watch a $350 million red bar print when Bitcoin (BTC) bounced. The pattern held into July 1’s window-dressing squeeze and then detonated July 9 when nearly $1 billion in short liquidation hit as price ripped toward $120,000.

Every tall bar tracks a violent wick on the price line, a reminder that volatility, not volume, shreds collateral.

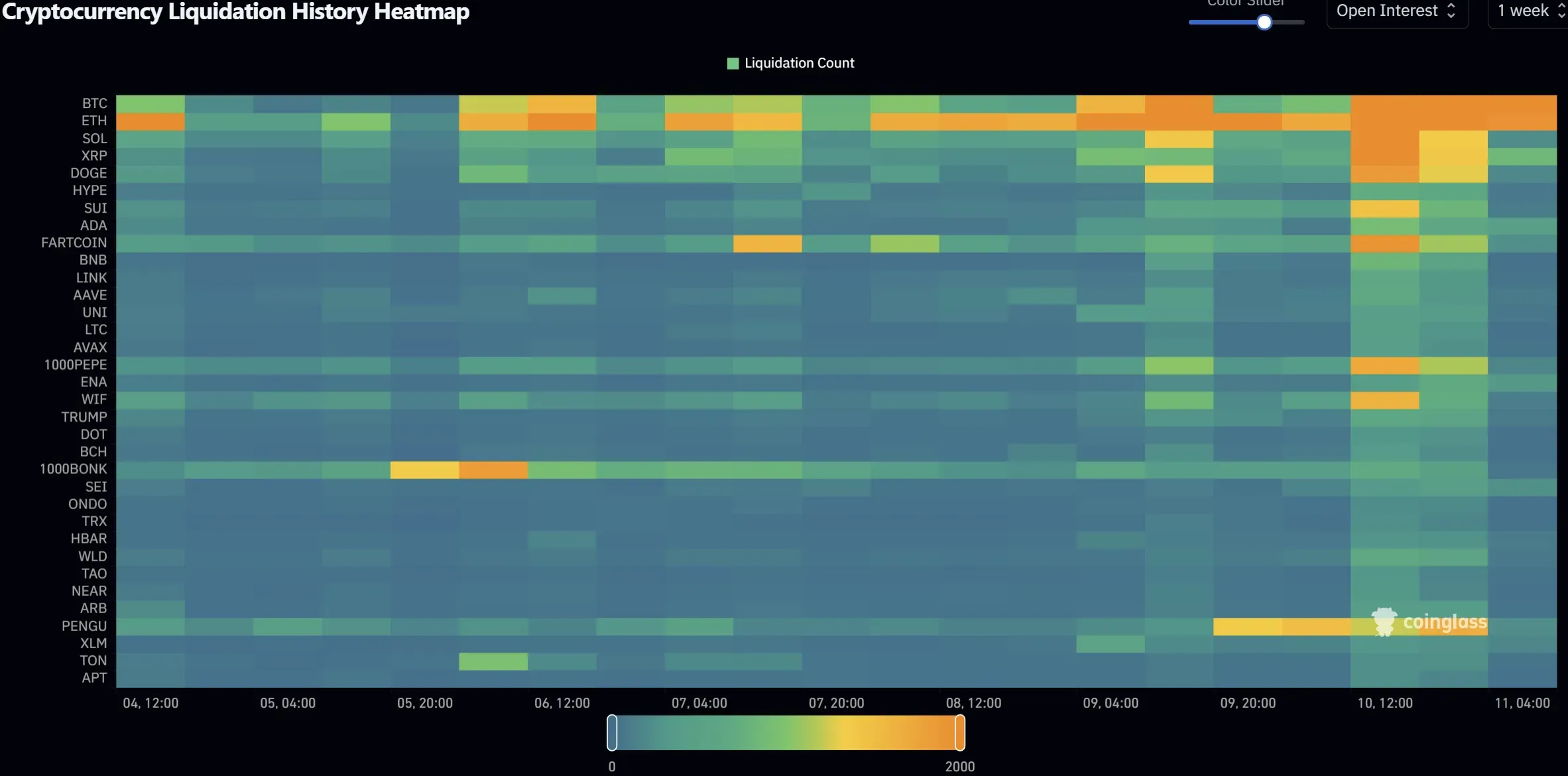

Zoom into the week of July 4-11 and the heat map glows like a bad sunburn.

A Friday payroll beat produced 1,500 BTC stop-outs plus 1,200 Ethereum (ETH), flipping majors from green to orange in a single hour. Meme-coin tourists arrived next: 1,000 BONK (BONK) lit multiple orange boxes over the July 5-6 weekend as retail chased the wrong candle.

By July 9 the board was wall-to-wall orange with BTC maxing the 2,000-count cap and nearly every top-twenty token recording 800 or more forced closes.

Notice the domino: majors flash first, alt rows follow within three hourly cells. Low-beta names like TON, APT, and NEAR stayed blue or green, proving that little leverage equals little drama when volatility spikes.

Big picture: the roulette wheel is spinning faster.

Two separate billion-dollar liquidation events in thirty days show traders rebuild leverage almost instantly after each wipeout. Head-count ceilings jumped from 1,200 last month to 2,000 and have already been tagged twice.

Macro headlines still pull the trigger (payroll surprises, hawkish Fed remarks) and technical breakouts occurred within minutes of every orange cluster.

One practical rule keeps paying rent: if the day’s liquidations top $600 million or if there is any print with 1,500 forced closes, a counter-move usually hunts the opposite side’s stops inside forty-eight hours.

Respect volatility, monitor liquidation prints, and size trades like you enjoy keeping your collateral instead of donating it to the funding pool.

Also See: Band Protocol Turns Data Into an Edge

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_vir_biotech_jpg_f43ff73654.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2170386387_jpg_600d460275.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669423_jpg_f410427536.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_tesla_fsd_jpg_f113fd1ea5.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212147411_jpg_a8bf4473f2.webp)