Advertisement|Remove ads.

ETH Valuation: Not Cheap, Not Frothy

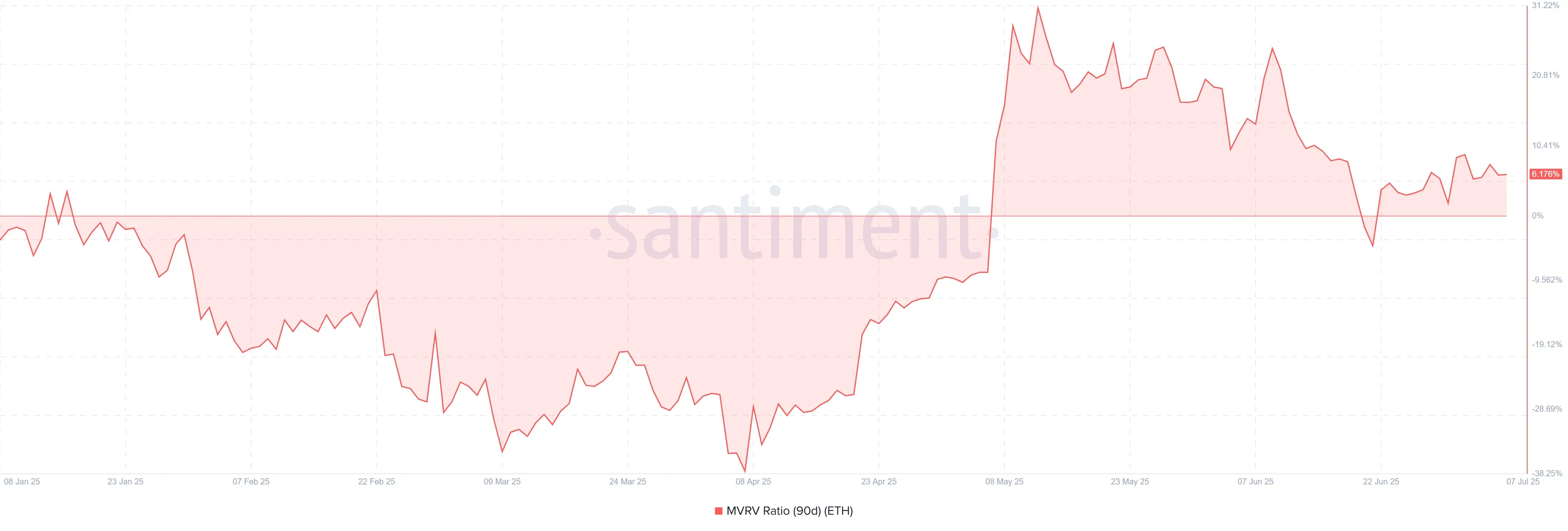

Ethereum’s (ETH) on chain mood ring, the MVRV ratio, just spent six months bouncing from doom to mildly optimistic and traders are trying to decide if the next move is champagne or Rolaids.

The 90 day reading bottomed at minus 0.27 in late February, screamed up to plus 0.31 by mid-May, and now rests near plus 0.06.

Translation: short-term wallets went from bleeding to bragging and now sit on modest gains, a setup where good news can launch a rally while any wobble invites profit grabs.

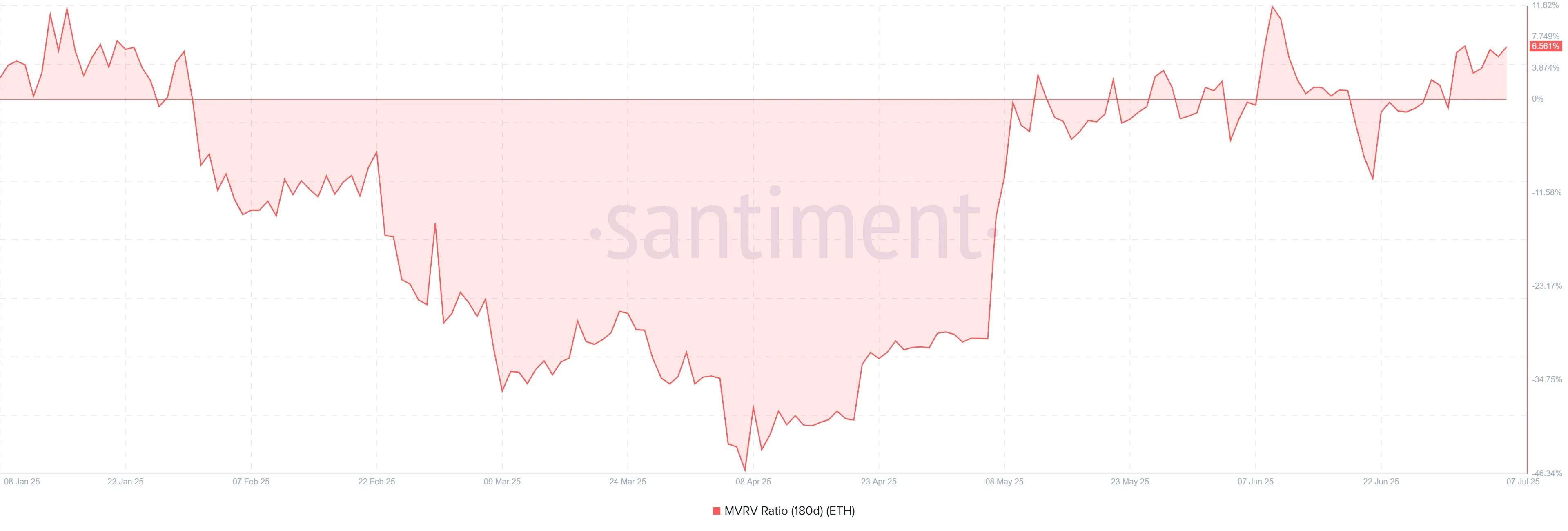

Zoom out to the 180 day view and the drama looks calmer.

That curve plunged to minus 0.46 on April 8 then crawled back to plus 0.07 by July 8. Long-term holders are barely in the green, so they are unlikely to dump but also unlikely to chase rallies unless something flashy appears, like the next staking tweak or a macro tail-wind.

Bulls see textbook accumulation. Both ratios wallowed in capitulation territory from February through April, a zone that often precedes face-ripping rebounds. The quick flip to positive in May shows fresh bids are real, and with the 180 day line still low there is room before the market looks frothy.

Bears counter that the 90 day spike already screamed overbought at plus 0.3, a level that whispers “take profits.” Momentum faded through June and day-to-day chop around zero hints at a tired trend. If macro headwinds pick up or layer-2 hype steals oxygen, Ethereum could drift or even revisit spring lows.

Realistically the data screams middle lane. Both ratios hover just above zero, signalling fair value.

Expect chop until an external catalyst tips sentiment. Smart money accumulates when the lines dip negative, trims when the 90 day ratio races past 0.3, and otherwise leaves the hopium pipe on the shelf.

For now Ethereum sits in valuation limbo, and that is perfectly boring.

Also See: NEAR’s Inflation Halving Hangs On Validator Vote

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Sarepta_Therapeutics_jpg_6cce13dbca.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_conocophillips_resized_98da51d9b9.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2239226376_jpg_c72fd10c8b.webp)