Advertisement|Remove ads.

Trump’s Subpoena Against Jerome Powell Triggers $21 Million Crypto Market Liquidations In One Hour

- Federal Reserve Chair Jerome Powell addressed Grand Jury subpoenas, triggering about $21.25 million in one-hour liquidations across Bitcoin, Ethereum, and Solana.

- Bitcoin continued to maintain its price above $92,000 and has seen a significant increase in the number of short sellers being liquidated.

- Although Bitcoin is currently testing the critical $92,000-$93,000 resistance level, analysts and market observers pointed out improving technical signals and on-chain data.

The Federal Reserve Chairman Jerome Powell delivered an announcement regarding the issuance of Grand Jury subpoenas that resulted in $21.25 million worth of Bitcoin (BTC), Ethereum(ETH), and Solana (SOL) being liquidated in just one hour on Sunday.

During his Senate testimony regarding renovation projects, Jerome Powell reiterated the importance of an independent Federal Reserve and an evidence-based approach to monetary policy.

Bitcoin’s price was trading at $92,217, up nearly 1.9% over 24 hours. Liquidations over the past day were skewed towards shorts, with roughly $230 million in shorts, while $6.2 million was in longs. On Stocktwits, retail sentiment around Bitcoin remained in ‘bullish’ territory, as chatter remained at ‘normal’ levels over the past day.

Analyst Remain Bullish Yet Cautious

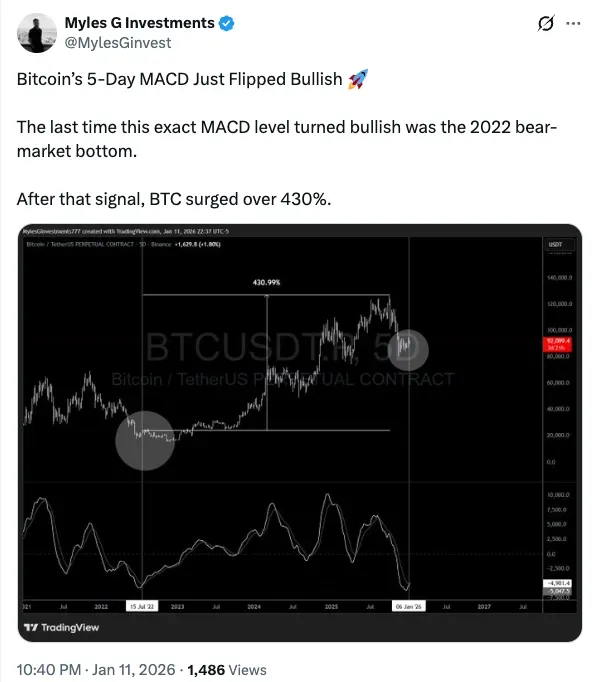

Several analysts have now pointed to improving technical and unchained signals. Myles G Investments said on X that Bitcoin’s five-day MACD has flipped into bullish territory, a signal that was last seen near the market bottom during 2022.

Previously popular crypto market analyst Willy Woo highlighted that launching flows for Bitcoin appear to have bottomed. However, the price remained below the estimated miner cost zone at $102,000 that is historically aligned with long-term accumulation phases. Some market watchers like Laxman believe that Bitcoin is reaching an important resistance zone near $92,000 to $93,000, which he thinks should be treated as “resistance until broken.”

Altcoins Follow Risk-on Tone

Generally, macro factors such as announcements from the Federal Reserve often influence the market. Bitcoin's bullish outlook was shared by the altcoin market, where Ethereum traded around $3,156 of 2.3% on the day, with notable short-side liquidation outweighing longs. In total, Ethereum saw nearly $27.6 million in liquidations in the last 24 hours.

On Stocktwits, Ethereum’s retail sentiment dropped from ‘neutral’ territory to ‘bearish’, despite the uptick in price. Chatter around it also dropped from ‘normal’ to ‘low’ territory over the past day.

Solana (SOL) was trading at $142, gaining nearly 5% in 24 hours as total liquidation for the token remained at $104 million in the last 24 hours. On Stocktwits, retail sentiment around Sola remained in bearish territory, with chatter levels at ‘normal’ over the past day.

Dogecoin (DOGE) was trading at approximately $0.141, rising around 1.9% during the past day, and has had $4.10 million in total liquidated positions in the last 24 hours. On Stocktwits, retail sentiment around Dogecoin dropped from ‘bullish’ territory to ‘bearish’ territory over the past day as chatter around it also dipped from ‘normal’ to ‘low’ levels.

Cardano (ADA) was trading at approximately $0.40, up 3.2% over the last day, and there were relatively low liquidations of approximately $0.48 million. On Stocktwits, retail sentiment around Cardano remained in ‘bullish’ territory as chatter levels dropped from ‘normal’ To ‘low’ levels over the past day.

Ripple’s XRP (XRP) was trading around $2.10 and has upticked about 0.4% during the last 24 hours. Approximately $8.08 million in liquidated positions occurred as a result of long-side buying pressure. On Stocktwits, retail sentiment around XRP dropped from ‘bullish' to ‘neutral’ territory, accompanied by ‘high’ chatter levels over the past day.

Read also: Binance Chain Leans Into Meme Culture, As BNB Dividends Yield Crosses US Stocks

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2255969940_jpg_0903b745a1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_LUNR_Intuitive_resized_cab4ddef01.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217856934_jpg_29efdc61ed.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)