Advertisement|Remove ads.

White House Plans To Drop Crypto Bill If Coinbase Does Not Comply

- Coinbase’s withdrawal to support the Clarity Act has now prompted the White House to drop its backing for the bill, according to Eleanor Terrett.

- Coinbase CEO Brian Armstrong warned that the language used in the Clarity Act would ban passive yield on stablecoins, among others, arguing that it gives banks an edge over crypto companies and undermines the American people.

- Analysts at TD Cowen also view this as “negative for crypto and positive for banks” and said it could derail legislation in Congress.

Coinbase (COIN) CEO Brian Armstrong has yanked the company’s support for the Senate’s Digital Asset Market Clarity (CLARITY) Act draft, turning up the heat on one of Washington’s most-watched crypto policy efforts, prompting the White House to pull its backing for the bill altogether.

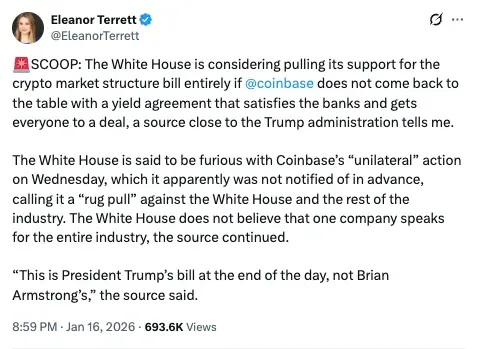

The White House is considering pulling its support for the crypto market structure bill entirely if Coinbase doesn’t come back to a deal with a yield framework that “meets the banks and gets everyone to a deal,” according to journalist Eleanor Terrett, who cited an anonymous source close to Trump’s administration.

The source added that officials were not too happy at Coinbase’s “unilateral” action, saying, “The White House does not believe that one company speaks for the entire industry.” Terrett also said on X that according to the source, it “is President Trump’s bill at the end of the day, not Brian Armstrong’s.”

Coinbase (COIN) closed at $241.15 on Friday and is flat in after-hours trading on Saturday. On Stocktwits, retail sentiment around Coinbase remained in ‘bullish’ territory, accompanied by ‘high’ chatter levels over the past day.

Why Coinbase CEO Is Against The Clarity Act

Last week, Armstrong publicly slammed the draft bill, cautioning that its language, as it stands, would effectively prohibit tokenized stocks, inflict prohibitive restrictions on DeFi, and outlaw passive yield on stablecoins. Armstrong sees this move as about protecting bank deposit franchises rather than promoting innovation. He was also possibly considering withdrawing support for the bill.

Speaking to CNBC, Armstrong said:

“Stablecoins are an opportunity for both banks and crypto companies, but the rules should create a level playing field so American firms can compete on the merits of their products. What’s not acceptable is banks using regulation to put their thumb on the scale and kill competition while paying just 14 basis points on savings, when consumers could earn closer to 3.8% on stablecoin rewards. We’re going to keep fighting for our customers and the 52 million Americans who use crypto so people can earn more on their money.”

The policy uncertainty has further stretched out the regulatory overhang across crypto markets. According to TheFly, TD Cowen wrote in a note that Armstrong’s opposition will probably sink market structure legislation in Congress, describing the result as “negative for cryptos and positive for banks.”

Read also: Bitcoin Stays Put At $95K Amid White House’s CLARITY Act Delay

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_price_fall_down_chart_representative_image_resized_08c968e73c.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_uniqure_jpg_33b6552285.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trending_stock_chart_jpg_3ff1b3a682.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228107699_jpg_f433126e50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227347233_jpg_00e33be418.webp)