Advertisement|Remove ads.

Adani Energy, A Long-term Trade Bet? SEBI RA Saurabh Sahu Sets ₹1,800 Target Over 2 Years

SEBI-registered analyst Saurabh Sahu is bullish on Adani Energy Solutions, a key player in Adani Group’s expanding energy infrastructure portfolio, driven by its strong technical setup and fundamentals.

He notes that the stock has rebounded from 2023 lows of ₹550–600, and is now showing a pattern of higher highs and higher lows, which is a sign of recovery and trend reversal.

Sahu highlights the key resistance zone between ₹950 and ₹970 to watch for a potential breakout. Short-term support is seen at ₹800 and major support at ₹600

The Relative Strength Index (RSI) stands near 50–55, indicating strength without being overbought.

From a long-term perspective, the stock is consolidating after a massive rally in the past.

According to Sahu, this base-building phase may be laying the ground for the next uptrend.

He notes that early signs of a cup-and-handle or a rounding bottom formation are emerging, though volatility remains high.

He advises buying Adani Energy Solutions at the current level (₹874) and adding further if the stock corrects to ₹550–600, with a target at ₹1,800 in a 2-year holding period, and a stop loss of ₹450.

Fundamentally, he believes that Adani Energy is poised to gain from the government’s push for electrification and infra, making it a long-term thematic play.

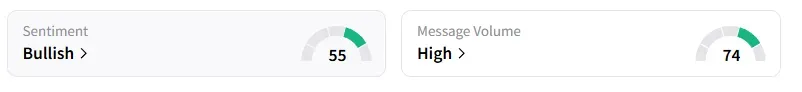

Data on Stocktwits shows retail sentiment turned ‘bullish’ from ‘bearish’ on this counter a day ago.

Adani Energy shares have gained 7% year-to-date (YTD).

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Jane_Street_3ac3fb6443.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Truth_social_5bfbc7389b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2221283194_jpg_8178c730a4.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Morgan_Stanley_HQ_logo_5431c7f2ad.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)