Advertisement|Remove ads.

Adani Enterprises Holds Key Support Despite US Scrutiny Reports: SEBI RA Priyank Sharma

Adani Enterprises shares fell nearly 2% on Tuesday on reports of scrutiny from U.S. authorities regarding alleged Iranian LPG imports. A Wall Street Journal report alleged that several gas tankers travelled via Mundra port, which the Adani Group operates.

The Adani Group refuted the allegations as "baseless and mischievous" in a June 2 statement, denying the claims made against them.

SEBI-registered analyst Priyank Sharma notes that despite the negative sentiment in the broader narrative, the stock's ability to hold above the ₹2,135 level reflects underlying strength.

According to him, this resilience suggests that the support level is structurally strong and may continue to hold.

Sharma believes that a breakout above ₹2,735 would indicate a clear sign of strength and could mark the beginning of a fresh upward move. Until then, the price is likely to remain in consolidation.

He adds that while investors may be growing impatient, a breakout above ₹2,735 may trigger a short-term rally towards ₹3,070, potentially leading to a broader move into price discovery.

On the downside, Sharma sees ₹2,135 as a critical support and should be monitored closely.

He believes that as long as the stock respects this level, the broader bullish structure remains intact.

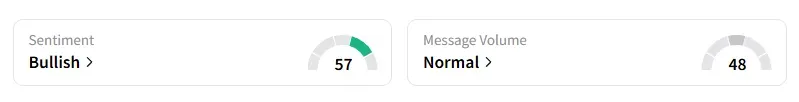

Data shows that retail sentiment is ‘bullish’ on this counter.

Adani Enterprises shares are down 2% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1959831267_jpg_c83b1e0d88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/moderna_hq_resized_jpg_97563ed423.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_WU_Western_Union_dc673aaa7c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Stock_market_Image_public_domain_declining_wc_96197f57d2.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2149589805_jpg_ceec7778b8.webp)