Advertisement|Remove ads.

AG, PAAS, HYMC Stocks Gain Premarket As Spot Silver Extends Record Rally Past $66

- Earlier this week, First Majestic began preliminary mine planning for the Navidad and Santo Niño discoveries in Mexico and reported strong drill results that significantly expand gold and silver mineralization.

- On Monday, Hycroft announced initial 2025–2026 exploration drill results from the Hycroft Mine in Nevada, highlighting the highest grades yet at the Vortex zone.

- Both gold and the U.S. dollar index were up around 0.3% each.

Shares of silver miners climbed in premarket trading on Wednesday after the precious metal surged to another all-time high, extending a record-setting rally that has unfolded over the past two weeks.

Spot silver (XAG/USD) prices jumped to $66.5 an ounce, going past the previous record of $64.6 an ounce set last Friday. In just six sessions, the metal has gained $6 an ounce.

At the time of writing, spot silver was up 3.2% while silver futures for March 2026 deliveries jumped nearly 4% to $65.8 an ounce.

Silver demand has jumped due to industrial demand as its use in solar panels and electric vehicles continues to grow, renewing the metal’s importance and raising concerns that supply may struggle to keep pace. Uncertainties about the dollar amid the Fed’s rate cut have also increased demand.

How Are Silver Stocks Performing?

First Majestic Silver Corp. (AG) gained over 3% in the premarket and is among the top-trending tickers on Stocktwits. AG stock hit its highest levels since June 2021 on Friday.

Last month, First Majestic Silver posted a record quarterly revenue of $285.1 million, and a record quarterly silver production of 3.9 million ounces, representing a 96% year-on-year increase. The company also reported net earnings of $43 million compared to a loss of $26.6 million.

Earlier this week, First Majestic Silver began preliminary mine planning for the Navidad and Santo Niño discoveries in Mexico and reported strong drill results that significantly expand gold and silver mineralization.

Other stocks, including Pan American Silver (PAAS), gained 2.5%, Endeavour Silver Corp. (EXK) climbed 2.8%, while Hycroft Mining Holding Corp. (HYMC) rose 0.4%.

On Monday, Hycroft announced initial 2025–2026 exploration drill results from the Hycroft Mine in Nevada, highlighting the highest grades yet at the Vortex zone.

How Did Stocktwits Users React?

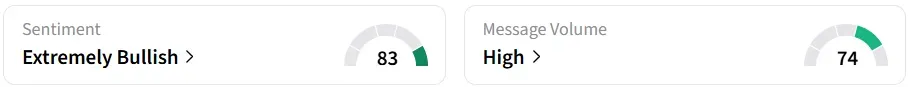

Retail sentiment for AG on Stocktwits remained in the ‘extremely bullish’ territory over the past 24 hours, amid ‘high’ message volumes.

Users expect a strong upside.

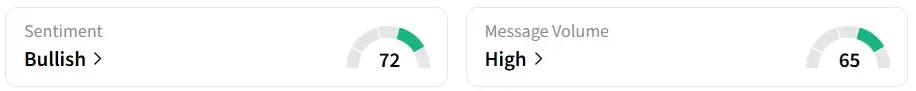

Retail sentiment for HYMC remained ‘bullish’, amid ‘high’ message volumes.

Gold And Greenback Watch

Spot gold prices gained 0.3% to $4,313.5 per ounce on Wednesday. The bullion hit its highest levels since October last Friday. Gold Futures for February 2026 deliveries rose 0.2% at $4,340 per ounce.

Year-to-date, gold prices have jumped over 65% but is significantly behind silver’s meteoric 124% surge.

The U.S. Dollar index (DXY) was up 0.3% at 98.54, having fallen to its lowest levels since October 3on Tuesday.

Read also: Another Solana Memecoin Ecosystem Gains Traction After US Class-Action Lawsuit Targets Pump.fun

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_altcoins_5a22b361ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)