Advertisement. Remove ads.

AGNC Stock Dips After Q3 Earnings Miss: Retail Stays Positive

Shares of real estate firm AGNC Investment Corp. ($AGNC) lost nearly 2% in Tuesday morning trade after its third-quarter earnings missed analyst expectations on earnings, but retail sentiment stayed positive.

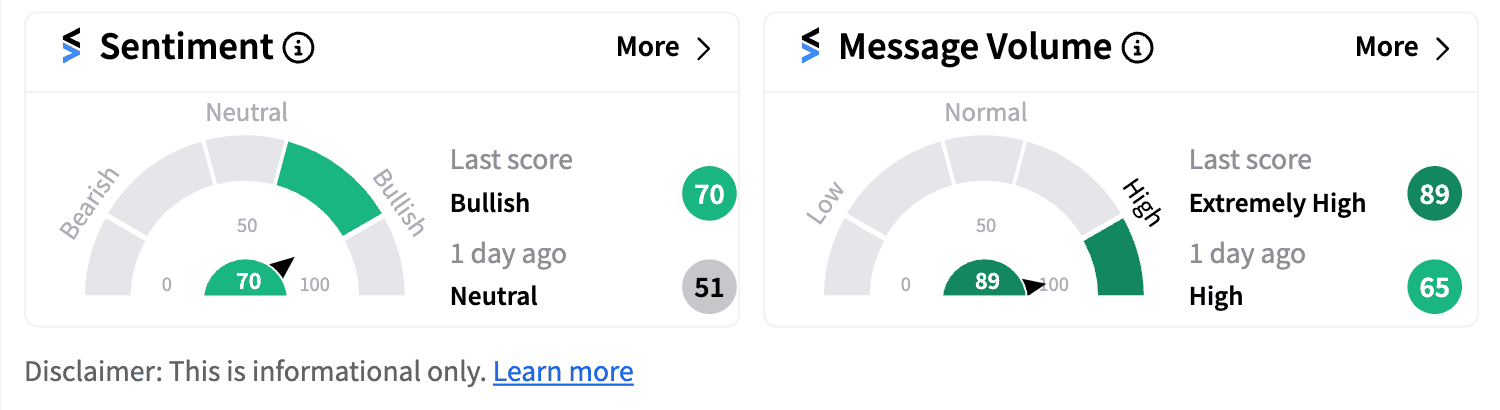

Sentiment on AGNC stock turned ‘bullish’ from ‘neutral’ a day ago. Message volumes inched up to ‘extremely high.’

Bethesda, MD.-based AGNC, which operates a real estate investment trust, posted $0.43 in earnings per share (EPS), below $0.50 estimated by analysts. The firm’s revenues, however, beat expectations by 6.81%, clocking at $756 million.

For the third quarter, the firm has announced a dividend of $0.36 per common share, according to a statement.

"AGNC generated a very strong economic return of 9.3% in the third quarter, driven by significant book value growth and our compelling monthly dividend, which has remained stable at $0.12 per common share for 55 consecutive months" Peter Federico, President and CEO of AGNC, said in the statement.

He noted the firm’s year-to-date performance, particularly a 13.8% unannualized economic return, that was attributed to its active portfolio management and the “increasingly positive macroeconomic conditions.”

As of Sept. 30, the firm’s investment portfolio stands at $73.1 billion. That includes $68.0 billion of agency MBS and $4.1 billion of "to-be-announced" securities. Its tangible net book value per common share as of Sept 30 was $8.82 per share, an increase of 5% over the previous quarter.

In the third-quarter, it also Issued 78.1 million shares of common equity through “At-the-Market” offerings, raising about $781 million.

Stocktwits users were optimistic on the firm’s long-term prospects.

AGNC’s stock is up 5.75% year-to-date.

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/01/piramal-aranya-arav-2025-01-9ca6001c2614d6f431d1dde76b7bdeeb.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2023/08/adani.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/09/img-20250906-wa0020-2025-09-5eb06bd17ff7f09275c65cf5224cebaf.jpg)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/03/cars-auto-sales-trade-2025-03-112a2d39607959bc768b9aab6126e355.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228106047_jpg_9b9a5ca202.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2025/02/anand-singha-thumnails-90-2025-02-69074ef2fa5040cebb8fe5d51a8f98e4.jpg)