Advertisement|Remove ads.

AI Is Reshaping Wall Street Bets: Morgan Stanley Reportedly Lifts Targets For These Two Chip Giants

- Morgan Stanley raised its price target on Nvidia to $250 from $235.

- Analyst Joseph Moore cited that the AI bellwether continues to dominate market share despite perceived threats.

- The firm also reiterated its overweight rating for Broadcom, raising its price target to $443 from $409.

Morgan Stanley is reportedly forecasting further upside for NVIDIA Corp. (NVDA) and Broadcom Inc. (AVGO) as artificial intelligence continues to drive growth in the semiconductor sector.

According to a CNBC report, the investment bank reaffirmed its bullish stance on the two chipmakers, emphasizing their strategic positions in the AI hardware market.

Nvidia Maintains AI Leadership

Morgan Stanley maintained its overweight rating for Nvidia, boosting the price target to $250 from $235, reflecting a potential 38% gain from Nvidia’s last closing price on Friday.

The report stated that analyst Joseph Moore cited the AI bellwether continues to dominate market share despite perceived threats. “Customers’ biggest anxiety for the next 12 months is their ability to procure enough NVIDIA product generally, and Vera Rubin specifically,” Moore added.

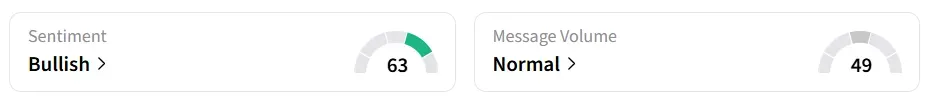

Nvidia’s stock traded over 1% lower in Monday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory amid ‘normal’ message volume levels.

NVDA stock has gained over 31% in 2025 and over 27% in the last 12 months.

Broadcom Gains AI Momentum

Morgan Stanley also reiterated its overweight rating for Broadcom, raising its price target to $443 from $409, approximately 10% above the company’s recent closing price on Friday.

Broadcom shares have surged 74% in 2025, fueled by growing demand for AI-related hardware, including its tensor processing units (TPUs), according to the report. Moore pointed out that Broadcom’s TPU business, supporting Google’s Tensor processors, is being revised upward, providing strong growth tailwinds.

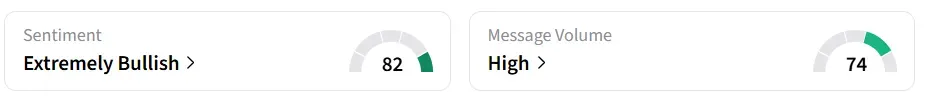

Broadcom’s stock traded over 1% lower in Monday’s premarket. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory, and message volume changed to ‘high’ from ‘extremely high’ levels in 24 hours.

Also See: Why Did Leggett & Platt Stock Surge 10% Pre-Market Today?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_App_Lovin_jpg_42d40549b1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_US_economy_representative_image_jpg_88c3aa4736.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_canada_jpg_0f117ea8e7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2166123192_jpg_1bb818cd90.webp)