Advertisement|Remove ads.

Ajanta Pharma Stock: Golden Crossover Suggests Fresh Rally, Says SEBI RA Mayank Singh Chandel

Ajanta Pharma may be gearing up for an upmove, despite its recent weakness.

The stock has declined in six of the nine previous sessions. It has underperformed the broader Nifty Pharma index, which is on track to gain for a sixth consecutive session.

The pharma company posted a 4% growth in net profit to ₹255.3 crore for Q1FY26 on Monday. Revenue from operations grew 13.8% to ₹1,302.7 crore, while EBITDA rose 6.3% to ₹351.3 crore. However, EBITDA margin shrank to 27% from 28.9% a year ago.

While Ajanta Pharma's stock gained on Tuesday, it is currently down 0.64% at ₹ 2,805.

Technical Analysis

According to SEBI-registered analyst Mayank Singh Chandel, the stock has been in a steady uptrend since April 2023.

After a recent healthy pullback, it has now flashed a bullish signal - Golden Crossover. This occurs when the 50-day exponential moving average (EMA) crosses above the 200-day EMA, a widely watched indicator that often suggests the beginning of a new upward trend.

Given that the pharmaceutical sector itself is showing relative strength, the signal gains further credibility, the analyst said.

Ajanta Pharma’s price structure also supports the bullish case. The stock has consistently formed higher highs and higher lows over the past several months, indicating strong underlying demand, Chandel added.

A successful breakout above recent swing highs could confirm trend continuation and potentially attract fresh buying interest.

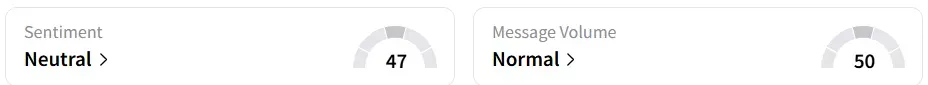

Data on Stocktwits shows that retail sentiment moved from ‘bearish’ to ‘neutral’ a day ago on this counter.

Year-to-date, the stock has shed 4.6%.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_Tether_2376a55503.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robert_kiyosaki_d28a01cb4b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_and_Ethereum_2b4356b70a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_976546456_jpg_42ddd4a81d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259655311_jpg_20124bbeb9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Donald_Trump_451371e34e.webp)