Advertisement|Remove ads.

Akamai Stock Tanks After-Hours As Disappointing Guidance Outweighs Q4 Beat: Retail Sentiment Sours

Akamai Technologies Inc. (AKAM) shares plunged over 9% in after-hours trading as the company’s guidance for the first quarter and fiscal year 2025 fell notably short of Wall Street expectations.

Akamai’s forecast for Q1 pegs earnings per share (EPS) between $1.54 and $1.59, while the consensus estimate was $1.66. Similarly, the company expects revenue in the $1 billion to $1.02 billion range, while analysts expect $1.04 billion.

For the full fiscal year 2025, Akamai guided for an EPS between $6 and $6.40, again short of an estimated $6.82. It expects to generate revenue of $4 billion to $4.20 billion, while Wall Street anticipated it to be $4.26 billion.

Akamai sprung a surprise for the fourth quarter, beating earnings estimates and posting in-line revenue.

The content delivery network and security solutions provider posted a revenue of $1.02 billion in Q4, up from $995 million during the same period last year.

Its EPS stood at $1.66 during the quarter, notably ahead of an estimated $1.52, but it declined year-over-year (YoY) from $1.69.

Akamai underscored that one of its largest customers is facing political headwinds, which could impact the company's top line by 1% to 2% over the next few years. It added that revenue growth and margin expansion are expected in fiscal year 2026.

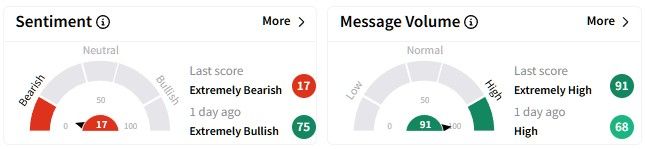

Retail sentiment on Stocktwits around the Akamai stock soured significantly, entering the ‘extremely bearish’ (17/100) territory from ‘bullish’ (74/100) a day ago.

Message volume surged to ‘extremely high’ levels as investors discussed Akamai’s Q4 performance and guidance for 2025.

One user highlighted that Akamai needs to cut costs after the company posted weak guidance.

Akamai’s stock has declined over 3.6% in the last six months, but its one-year performance is far worse, with a fall of over 9.5%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Opendoor_Technologies_jpg_177252e1f8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246131051_jpg_78a656bc06.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_lucid_gravity_jpg_173d7fb4ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2250240969_jpg_dd9be8c5ea.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trump_jpg_4a30f2c834.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_donald_trump_tariffs_chart_jpg_9309f5e523.webp)