Advertisement|Remove ads.

Albertsons Stock Slips As COO Susan Morris Named CEO, Retail Sentiment Remains Subdued

Albertsons Companies (ACI) shares fell 1.6% on Monday after the grocery retailer appointed COO Susan Morris as its next CEO.

Morris will succeed Vivek Sankaran, who will step down on May 1.

A nearly 40-year Albertsons veteran, she will also join the board.

“The board is confident that Susan is the ideal person to lead the company into its next chapter of growth. With a nearly 40-year career at the company that began at an Albertsons store in the Denver market, Susan brings unmatched expertise and deep knowledge of the business,” said Jim Donald, chair of Albertsons.

Morris said, “At a time of profound change for the grocery industry, I am honored to be appointed as the next CEO of Albertsons. I have worked closely with Vivek and the leadership team on our plans to accelerate growth and am confident that we are on the right path with our Customers for Life strategy.”

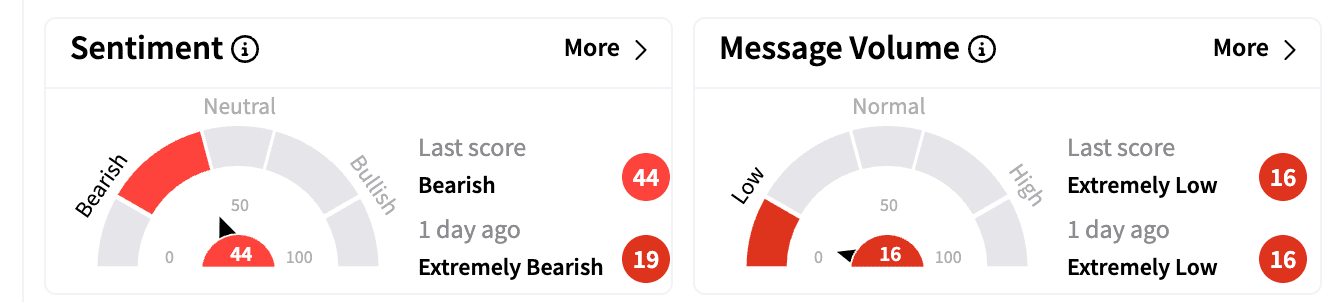

Retail sentiment on Stocktwits remained subdued, shifting from ‘extremely bearish’ to ‘bearish,’ with message volume staying ‘extremely low.’

Sankaran has led Albertsons for nearly six years and played a key role in the company’s attempted merger with Kroger, which the Federal Trade Commission ultimately blocked.

Before Albertsons, he was an executive at PepsiCo. News of his departure came the same day Kroger announced its CEO, Rodney McMullen, would resign following an investigation into his personal conduct.

Albertsons reaffirmed its fiscal 2024 outlook, projecting identical sales growth of 1.8%–2.0%, adjusted EBITDA between $3.95 billion and $3.99 billion, and adjusted EPS of $2.25–$2.31, in line with consensus.

The stock remains up 5.35% year-to-date.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2232102203_jpg_175efe6ca4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2257784104_jpg_4f7b38e8a2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_2026_jpg_f51342601b.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228864541_jpg_d94770c5a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_eric_trump_OG_jpg_19bc149869.webp)