Advertisement|Remove ads.

Alphabet Gets Price Target Boost Ahead Of Q2 Print: Retail Says ‘Google Is So Undervalued’

Alphabet Inc.(GOOGL) (GOOG) received a vote of confidence from Guggenheim as the research firm boosted its price target ahead of the tech giant’s second-quarter (Q2) earnings report.

The revised target increases to $210 from the previous $190, with the brokerage maintaining its ‘Buy’ rating on the stock, according to TheFly.

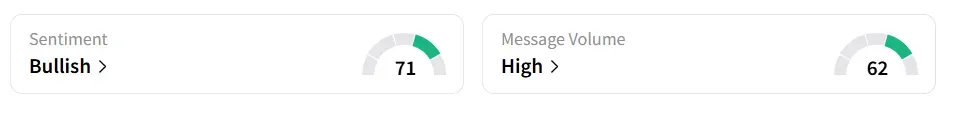

Alphabet stock inched 0.6% lower on Wednesday, after the morning bell. On Stocktwits, retail sentiment around the stock was highest in a week, improving to ‘bullish’ (71/100) from ‘neutral’ territory the previous day.

Message volume levels remained ‘high’ in the last 24 hours. The stock saw a 360% surge in retail chatter over the past month.

A bullish user said that ‘Google is so undervalued’ and expressed optimism about the earnings.

The research note outlines a slightly more optimistic revenue outlook, citing improved trends among advertisers throughout the quarter and favorable currency effects stemming from a weakening U.S. dollar.

According to Guggenheim, Alphabet’s core advertising business, particularly its Search and Other segment, is likely to post double-digit growth.

This performance is anticipated to surpass Wall Street's current expectations for the quarter, aided by a recovery in digital ad spending and continued momentum in key international markets.

According to Fiscal AI data, analysts expect Alphabet’s Q2 revenue to be $93.95 billion and the earnings per share (EPS) of $2.19.

The firm’s cloud division and YouTube business will also be closely watched as potential contributors to the upside.

In the first quarter, Alphabet reported earnings per share (EPS) of $2.81 and revenue of $90.23 billion. Google Cloud revenue rose 28% year-on-year (YoY) to $ 12.26 billion, and that of Google Services climbed 10% YoY.

The company will report its Q2 earnings on Wednesday after market close.

Alphabet stock has gained 0.45% year-to-date and more than 4% over the last 12 months.

Also See: AT&T, GE Vernova Among The Most Trending Stocks On Wednesday Morning: Here’s Why

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2222819201_jpg_edcbb1336e.webp)