Advertisement|Remove ads.

AT&T, GE Vernova Among The Most Trending Stocks On Wednesday Morning: Here’s Why

Telecommunications giant AT&T and energy equipment manufacturer GE Vernova trended on Wednesday morning after both companies reported better-than-expected second-quarter (Q2) earnings. Here’s a detailed look at the developments.

1. AT&T Inc. (T): The telecom giant’s Q2 revenue increased 3.5% year-on-year (YoY) to $30.8 billion, beating the analysts' consensus estimate of $30.4 billion as per Fiscal AI data.

Adjusted earnings per share (EPS) of $0.54 also surpassed the consensus estimate of $0.53.

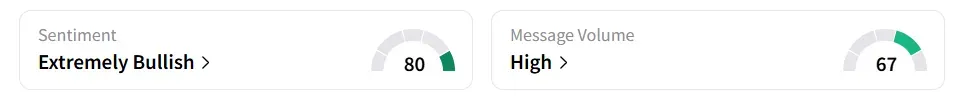

Retail sentiment toward AT&T improved to ‘extremely bullish’ (80/100) from ‘bullish’ territory the previous day. Message volume shifted to ‘high’ (65/100) from ‘normal’ levels in the last 24 hours.

Despite the earnings beat, AT&T stock traded over 2% lower in the premarket on Wednesday.

A Stocktwits user questioned the decline in the share price despite the upbeat earnings.

AT&T expects to realize $6.5 to $8.0 billion of cash tax savings during 2025-2027 due to tax provisions in the One Big Beautiful Bill Act.

This reflects estimated savings of $1.5 billion to $2.0 billion in 2025, $2.5 billion to $3.0 billion in 2026, and $2.5 billion to $3.0 billion in 2027.

AT&T stock has gained over 20% in 2025 and over 50% in the last 12 months.

2. GE Vernova Inc. (GEV): The energy giant’s Q2 revenue increased 11% year-on-year (YoY) to $9.11 billion, beating the analysts' consensus estimate of $8.79 billion, as per Fiscal AI data.

Earnings per share (EPS) of $1.86 also surpassed the consensus estimate of $1.5.

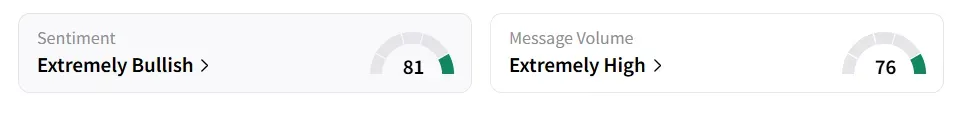

Retail sentiment toward GE Vernova improved to ‘extremely bullish’ (81/100) from ‘bullish’ territory the previous day. Message volume shifted to ‘extremely high’ (76/100) from ‘high’ levels in the last 24 hours.

Both retail sentiment and message volume were at a month-high.

A Stocktwits user expressed optimism at the numbers.

GE Vernova stock traded over 7% higher on Wednesday’s premarket.

“Based on our performance, we are now trending towards the higher end of our 2025 revenue guidance and have increased our expectations for adjusted EBITDA margin and free cash flow,” said CFO Ken Parks.

Also See: Here’s Why SAP, Pegasystems, Magnite Dominated Retail Chatter On Stocktwits Among Tech Stocks

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218096416_jpg_9d469a2ec6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2229019640_jpg_c6006d7238.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_trump_jpg_fc59d30bbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1190665957_jpg_92088206ed.webp)