Advertisement|Remove ads.

ResMed Draws Analyst Skepticism After Apnimed Announces Positive Results From Investigational Sleep Apnea Drug: Retail’s Unmoved

Analysts expect a negative impact on ResMed Inc. (RMD) after privately held pharmaceutical company and rival Apnimed, Inc. announced positive results from its late-stage clinical trial evaluating the efficacy of its lead candidate AD109 in treating obstructive sleep apnea.

Apnimed said on Tuesday that it plans to submit a new drug application to the U.S. Food and Drug Administration (FDA) by early 2026 for regulatory review of AD109, a once-daily pill taken at bedtime.

ResMed makes medical devices for treating sleep disorders such as sleep apnea.

RBC Capital said in a note to investors on Tuesday that the successful commercialization of AD109 would likely negatively impact ResMed's addressable market as AD109 "could offer a less invasive, more user-friendly and viable alternative" to ResMed’s machines.

RBC also noted that the company now has “a number of competitive threats on the horizon," including the possible return of Philips Respironics into the U.S. sleep apnea market after a recall of certain CPAP, BiPAP, and ventilator devices in 2021 because of potential health risks.

RBC Capital has a ‘Sector Perform’ rating on ResMed, as per TheFly.

Morgan Stanley analyst David Bailey, meanwhile, believes AD109 appears to focus on patients who are unable or refuse to tolerate CPAP, and expects only a “moderate” potential earnings impact for ResMed from Apnimed based on current data.

Bailey keeps an ‘Overweight’ rating on ResMed with a $286 price target.

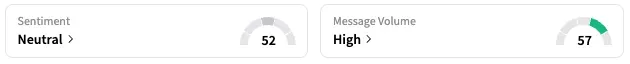

On Stocktwits, retail sentiment around ResMed stayed within the ‘Neutral’ territory while message volume stayed at ‘high’ levels.

RMD stock was down 2% on Tuesday at noon. However, it has risen by about 9% this year and by over 13% over the past 12 months.

Also See: Trump Reportedly Fails To Convince GOP Holdouts On Tax Bill

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_federal_reserve_jpg_7298dc8578.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_stock_jpg_9eab8bde17.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_kevin_warsh_jpg_0c2cd19926.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1959831267_jpg_c83b1e0d88.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/moderna_hq_resized_jpg_97563ed423.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)