Advertisement|Remove ads.

Wall Street Boosts Dell Price Targets on AI Surge Despite Mixed Q1 Results: Retail Confidence Jumps

Analysts have raised Dell Technologies Inc.'s (DELL) price target following the tech giant’s first-quarter (Q1) earnings results.

The Round Rock, Texas-based company’s Q1 revenue grew 5% year-on-year (YoY) to $23.4 billion, beating the consensus estimate of $23.19 billion, as per Finchat data.

The adjusted earnings per share (EPS) of $1.55 missed the estimate of $1.69.

Barclays increased its price target on Dell Technologies to $123 from $116 while maintaining an ‘Equal Weight’ rating on the stock.

Although Dell delivered a mixed performance in its fiscal first quarter, the standout figure was $12.1 billion in artificial intelligence orders, surpassing the total AI revenue for the entire previous fiscal year, according to Barclays’ note to investors.

The firm also noted that Dell's guidance for the full fiscal year remains unchanged, citing macroeconomic headwinds and reduced margins as ongoing pressures, though it suggests this outlook may be cautiously conservative.

Citi has raised its price target to $135 from $128 while reiterating a ‘Buy’ rating on the stock.

Despite ongoing macroeconomic challenges, Citi noted that Dell’s management has maintained its full-year revenue forecast. It believes the company’s strong growth in artificial intelligence is helping to counterbalance broader economic pressures in the enterprise segment.

Meanwhile, BofA increased its price target on the stock to $155 from $150 while maintaining a ‘Buy’ rating.

The firm explained that Dell's Q1 earnings per share landed at the lower end of the guidance range, mainly due to minor tariff-related pressure on client solutions group (CSG) margins and softer-than-expected growth in the intelligent security systems (ISS) division.

BofA opined that Dell is well-positioned to generate over $30 billion in AI server revenue over the next two years, with strong potential for EPS growth as momentum in the AI server space accelerates.

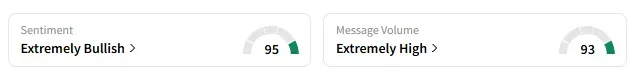

On Stocktwits, retail sentiment around Dell changed to ‘extremely bullish’ from ‘bullish’ the previous day.

Dell stock has lost over 1% year-to-date and over 33% in the last 12 months.

Also See: Scott Bessent Says Trump-Xi Call Needed As Talks With China Are ‘A Bit Stalled’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_oct23_jpg_588046d0a9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_patrick_soon_shiong_jpg_5f4d6bc18d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2246431195_jpg_539619e6b1.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262983094_jpg_2896f12e4a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2033244575_jpg_3f112039eb.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2256076198_jpg_06e5c2fdb6.webp)