Advertisement|Remove ads.

APLD Stock Jumped Over 16% Today – Roth Capital’s Price Target Still Leaves A Lot Of Upside Potential

- Roth pointed to expanding customer interest and large-scale discussions that could materially increase the company’s operating footprint.

- With 600 megawatts already under contract and additional projects in active development, the company appears well-positioned, the firm said.

- Applied Digital posted a 250% year-on-year jump in Q2 revenue, to $126.6 million.

Applied Digital Corp. (APLD) shares were in the spotlight on Thursday morning after Roth Capital highlighted an increasing demand for large-scale artificial intelligence infrastructure.

Analyst Darren Aftahi increased the price target on the stock to $58 from $56 while maintaining a ‘Buy’ rating, citing stronger-than-expected momentum following the company’s latest quarterly performance, according to TheFly.

Q2 performance

In the second quarter (Q2), the data center developer and operator reported a 250% year-on-year jump in revenue, to $126.6 million, and nil adjusted earnings per share (EPS). Both revenue and EPS came in better than the analysts’ consensus estimate of $81.2 million and a loss of $0.12 per share, respectively, according to Fiscal AI data.

Beyond the headline numbers, the earnings update highlighted Applied Digital’s growing role as a provider of specialized data center capacity. Management pointed to an active development pipeline that could materially expand the company’s footprint.

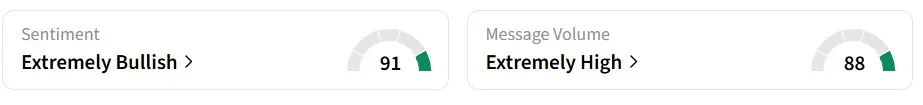

Applied Digital stock traded over 16% higher on Thursday morning. On Stocktwits, retail sentiment around the stock remained in ‘extremely bullish’ territory amid ‘extremely high’ message volume levels.

Analyst Rationale

Roth emphasized that financials were not the primary driver behind the upgrade. Instead, the firm pointed to expanding customer interest and large-scale discussions that could materially increase the company’s operating footprint.

The firm noted that Applied Digital is currently in advanced negotiations covering as much as 900 megawatts of capacity across several hyperscale locations. With 600 megawatts already under contract and additional projects in active development, the company appears well-positioned to scale alongside growing AI compute needs.

The analyst highlighted Macquarie-backed financing as a key support for Applied Digital’s expansion plans. Roth described the company as a pure-play AI infrastructure landlord, meaning it focuses on owning and leasing specialized facilities rather than operating compute workloads itself.

APLD stock has gained over 239% in the last 12 months.

Also See: Ondas Stock Shot Up 11% Today – What’s Driving The Investor Optimism?

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2192180432_jpg_5a4c947a6a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Cybersecurity_jpg_bb1da91dbe.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Vanda_jpg_943c16fa4f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2222341271_jpg_26b9066cf6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2249860620_jpg_2bd9e54f08.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)