Advertisement|Remove ads.

Applied Digital Stock Soars 30% On Thursday, And There’s A CoreWeave Angle To It

Applied Digital Corp. (APLD) CEO Wesley Cummins drew attention to CoreWeave’s (CRWV) recent deal for another 150 megawatts of capacity at a third facility on the Polaris Forge 1 campus, highlighting the site's growing role in powering advanced AI operations.

“Building on the momentum from these leases and the surging demand for AI infrastructure, we're actively marketing our multi-gigawatt pipeline to a diverse group of customers,” said Cummins during the fourth-quarter (Q4) earnings call.

Applied Digital stock traded over 30% higher on Thursday afternoon.

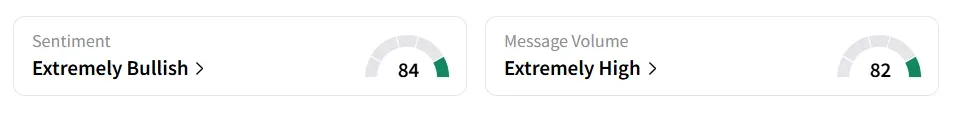

On Stocktwits, retail sentiment around the stock jumped to ‘extremely bullish’ (84/100) from ‘neutral’ territory the previous day. Message volume shifted to ‘extremely high’ (82/100) from ‘normal’ levels in 24 hours.

A bullish Stocktwits user said the stock has growth potential.

CoreWeave has previously agreed to lease 250 megawatts of power at the Polaris Forge 1 data center under two major 15-year deals, potentially bringing in $7 billion in revenue.

The latest addition of 150 megawatts, once finalized, would boost the total leased capacity to 400 megawatts and expected revenue to around $11 billion for Applied Digital.

“With the CoreWeave lease, we believe we're now roughly halfway toward our internal goal of generating $1 billion in annual net operating income over the next 3 to 5 years,” Cummins added.

Applied Digital’s Q4 revenue jumped 41% year-on-year (YoY) to $38 million, beating the analysts’ consensus estimate of $37.12 million, as per Fiscal AI data.

Adjusted loss per share of $0.03 surpassed the consensus estimate of a loss of $0.16. The company held $41.5 million in cash and equivalents as of May 31.

Applied Digital stock has gained over 68% year-to-date and over 164% in the last 12 months.

Also See: ‘Netflix of Gaming?’ Retail Hype Follows Roblox’s Big Q2 Win

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_140648412_jpg_05552b4117.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_912727778_jpg_3bd44c57ad.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1235943608_jpg_91702ef0ab.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_167578473_jpg_29255f031f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Michael_Burry_jpg_fa0de6ac92.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_winklevoss_1c7de389e0.webp)