Advertisement|Remove ads.

Applied Digital Stock Rockets 40% After $7B Deal With CoreWeave: Retail’s Exuberant

Shares of Applied Digital Corporation (APLD), which develops and operates advanced infrastructure for high-performance computing (HPC) shot up 40% on Monday after finalizing two long-term lease deals with AI infrastructure provider, CoreWeave.

These agreements, each spanning roughly 15 years, will enable Applied Digital to deliver 250 megawatts (MW) of critical IT power to support CoreWeave’s AI and HPC systems at its data center complex in Ellendale, North Dakota.

The company expects to generate around $7 billion in revenue over the lifetime of the leases. In addition, CoreWeave has the option to utilize an extra 150 MW of power at the site.

The Ellendale campus, developed by Applied Digital, is built to accommodate up to 400 MW of essential IT capacity.

The site also has over 1 gigawatt (GW) of power potential, undergoing multiple phases of load assessment, which provides the flexibility to scale further in support of growing AI and HPC infrastructure needs.

“As demand for AI accelerates exponentially, we believe that we are uniquely positioned to deliver substantial returns while supporting the evolving and dynamic needs of these rapidly evolving sectors. We view CoreWeave as an ideal partner as we accelerate our growth and innovation,” said Chairman and CEO of Applied Digital, Wes Cummins.

The region’s energy-efficient environment supports Applied Digital’s ability to scale quickly, helping to establish both the company and location as rising contenders in the AI data center landscape.

The first 100 MW data center dedicated to CoreWeave is slated to come online by the fourth quarter of 2025. A second structure, designed to support 150 MW of capacity, is currently under construction and is projected to be operational by mid-2026.

CoreWeave also holds a future option to utilize a third 150 MW facility, currently in planning and anticipated to launch in 2027.

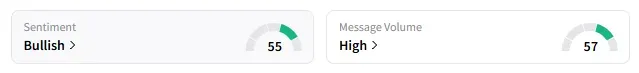

On Stocktwits, retail sentiment around Applied Digital changed to ‘bullish’ from ‘bearish’ the previous day.

A bullish Stocktwits user felt optimistic about the agreements.

Applied Digital stock has lost over 10% in 2025 and gained over 70% in the last 12 months.

Retail sentiment around CoreWeave remained in ‘neutral’ territory with the stock trading 3.4% higher.

CoreWeave stock has more than doubled in 2025 and in the last 12 months.

Also See: JetBlue Dismisses Merger Talk After Deal With United, Says Report: Retail Shares The Conviction

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230529087_jpg_ce4582941c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Meta_jpg_0f17dacb20.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2244842667_jpg_931c352b95.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_representative_image_resized_jpg_dacf5b1590.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1485519874_1_jpg_82b28a6517.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_rare_earth_july_d867df7d47.webp)