Advertisement|Remove ads.

JetBlue Dismisses Merger Talk After Deal With United, Says Report: Retail Shares The Conviction

JetBlue Airways Corp.(JBLU) clarified on Monday that its recently announced collaboration with United Airlines Holdings Inc.(UAL) is not a prelude to a full-scale merger.

According to a report from Reuters, JetBlue CEO Joanna Geraghty addressed concerns about a potential merger, referencing the company’s recent history with antitrust regulators.

“We've spent a lot of time with the Department of Justice over the last five years, and we're playing it safe,” Geraghty said, suggesting the airline intends to steer clear of regulatory entanglements following the collapse of its attempted merger with Spirit Airlines.

The Department of Justice (DOJ) had previously blocked JetBlue’s proposed acquisition of Spirit Airlines Inc. (SAVE).

This statement comes just days after the two airlines revealed a new booking and loyalty integration meant to enhance convenience for travelers.

Under the arrangement, passengers can now book flights across both airlines’ platforms and accrue or redeem loyalty points through either company’s frequent flyer program.

The newly unveiled arrangement allows both carriers to share takeoff and landing slots at John F. Kennedy International Airport and Newark Liberty International Airport, enhancing operational efficiency without pursuing a full corporate merger.

However, despite speculation following the announcement, JetBlue’s leadership dismissed any notion that the partnership signals deeper corporate consolidation.

The JetBlue-United tie-up follows a series of strategic shifts in the airline industry, where companies are increasingly opting for cooperative agreements rather than pursuing high-risk mergers.

This approach allows airlines to expand their reach and loyalty ecosystems without drawing scrutiny from antitrust authorities.

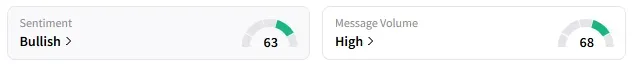

On Stocktwits, retail sentiment around JetBlue remained in ‘bullish’ territory with high message volume.

A Stocktwits user supported the alliance without a merger.

JetBlue stock has lost over 35% in 2025 and over 10% in the last 12 months.

Also See: Microsoft Commits $400M To Boost Swiss AI, Cloud Ecosystem: Retail Mood Stays ‘Bearish’

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1549425533_jpg_483afd6d69.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_down_resized_901c19c371.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2235778544_jpg_2b7ceca102.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_hawaiian_electric_resized_4b766fd741.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_sealsq_stock_market_representative_resized_b05435011f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2230137825_jpg_d14459f501.webp)