Advertisement|Remove ads.

Ardelyx Stock Rises After-Hours On Q4 Beat, Drug Sales Outlook: Retail Gets Big Dose Of Optimism

Shares of biopharma company Ardelyx, Inc. (ARDX) edged up about 0.5% in after-hours trading on Thursday after closing lower during the regular session as investors processed its quarterly earnings and drug sales projections.

Ardelyx swung to a fourth-quarter (Q4) net income of $0.02 per diluted share from a loss of $0.12 a year earlier, surpassing analyst expectations of breakeven.

Revenue for the quarter was $116.13 million, topping the consensus estimate of $111.16 million, driven by robust sales of its two approved drugs, Ibsrela and Xphozah.

Total revenue for the year ended Dec. 31, 2024, was $333.6 million, compared to $124.5 million a year earlier.

Ibsrela, its treatment for irritable bowel syndrome with constipation, generated $53.8 million in Q4 net product sales revenue, reflecting about 32% growth from Q3.

Full-year 2024 sales reached $158.3 million, and the company expects U.S. net product sales for 2025 to range between $240 million and $250 million.

Ardelyx projects Ibsrela to achieve over 10% market share at peak and exceed $1 billion in annual U.S. revenue before its patent expires in 2029.

Xphozah, used to manage serum phosphorus levels in adults with chronic kidney disease on dialysis, recorded $57.2 million in Q4 net product sales.

In 2024, Xphozah's first full year of commercialization saw U.S. sales hit $160.9 million. The company estimates that peak annual U.S. sales will reach $750 million before its patent expires.

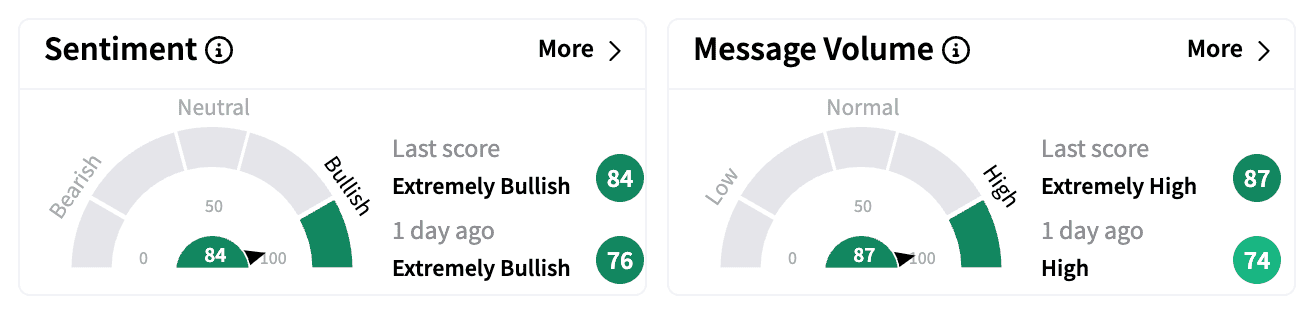

On Stocktwits, sentiment for ARDX surged deeper into the 'extremely bullish' zone, with message volume spiking 240% in 24 hours.

One user highlighted IBSRELA's trajectory toward blockbuster drug status, while another reinforced faith in the company's fundamentals.

Ardelyx ended 2024 with $250.1 million in cash, cash equivalents, and short-term investments, up from $184.3 million a year earlier.

The stock has gained over 13% year-to-date, though short interest has increased from 10% at the start of 2025 to about 11.2% last week, per Koyfin data.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2241292402_jpg_9661b0c852.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_stock_rising_resized_f17852d7aa.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_adam_smigielski_K5m_Pt_O_Nmp_HM_unsplash_f365ee93f4.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2058827032_jpg_5505a2a083.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_526218674_jpg_7b7468812b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_539991424_jpg_eeab1e0e26.webp)