Advertisement|Remove ads.

Arm Holdings Stock Edges Lower Despite Q3 Earnings Beat, Wave Of Price Target Hikes: Retail Stays Extremely Bullish

Arm Holdings Plc. (NASDAQ: ARM) stock fell 3.7% after the chip designer’s earnings outlook for the current quarter was in line with expectations, denting hopes that AI demand will spur outsized sales.

Arm Holdings reported earnings per share (EPS) of $0.39 during the third quarter, higher than estimates of $0.34, according to Stocktwits data.

The chip designer also beat revenue estimates — its actuals were $983 million versus the consensus of $949 million.

The company guided for fourth-quarter revenue in the range of $1.18 billion to $1.28 billion, while the consensus estimate is $1.22 billion.

Its fourth-quarter EPS guidance is between $0.48 and $0.56, while the consensus is $0.52.

After the third-quarter earnings beat, Arm Holdings stock received a flurry of price target upgrades from Jefferies, JPMorgan, Citi, and other brokerages. According to TheFly, the new price targets range from $174 to $225.

One factor that could impact investor sentiment is Arm’s license lawsuit against Qualcomm Inc. (QCOM), one of its major partners.

During its post-earnings call on Wednesday, Qualcomm revealed that the British semiconductor designer has withdrawn its breach notice.

"Arm recently notified us that it was withdrawing its October 22, 2024 notice of breach, and indicated that it has no current plan to terminate the Qualcomm architecture license agreement," Qualcomm CEO Cristiano Amon told analysts during the call.

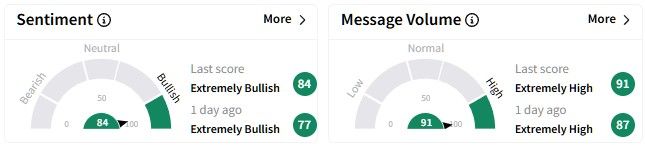

However, retail sentiment on Stocktwits around the Arm Holdings stock remained in the ‘extremely bullish’ (84/100) territory, while message volume also saw an increase, hovering in the ‘extremely high’ zone.

One user quipped that investors with short positions on Arm Holdings stock should watch out for an upward movement after the wave of price target hikes that poured in after the earnings report.

Arm Holdings’ share price has gained nearly 53% over the past six months, while its one-year returns stand at an impressive 137%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ras_tanura_jpg_b79d6fe085.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2202580632_jpg_9b97227b1a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ACHR_resized_jpg_25097dbec7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Plug_resized_jpg_82cf2f0bcd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/astspacemobile_resized_jpg_8a6aa92413.webp)