Advertisement|Remove ads.

ASML Stock Gains Pre-Market As 2025 Forecast Stands Firm Despite Tariff Threat To China Sales – Retail Remains Cautious

U.S.-listed Shares of ASML Holding (ASML) gained over 2% in pre-market trade on Wednesday as the semiconductor equipment giant reiterated its sales forecast for the year despite uncertainty ahead, given the growing impact of tariffs.

“External factors such as the timing of subsidies and the risk of restrictions make forecasting market demand less predictable,” the Netherlands-based company said in its annual report.

ASML, which supplies chip-making machines to Taiwan Semiconductor Manufacturing Co. (TSMC), Samsung, SK Hynix, SMIC, and Intel, said that customers are exercising greater caution in capital expenditure due to geopolitical risks.

In its annual report, ASML noted that factors such as "technological sovereignty and export controls" prompted clients to manage cash flow more conservatively in 2024.

The company reported that 36% of its 2024 sales came from China, but many entities are now subject to trade restrictions.

ASML expects that share to shrink to around 20% in 2025 as stricter U.S. regulations curb access to its high-end semiconductor manufacturing equipment.

The company warned of "increasingly complex restrictions and possible countermeasures" that could further complicate its operations.

Despite these headwinds, ASML reaffirmed its 2025 sales target of €30 billion to €35 billion ($32.04 billion to $37.38 billion), up from €28.3 billion in 2024. It cited strong demand for its extreme ultraviolet (EUV) lithography systems, which are needed to create the circuitry of computer chips.

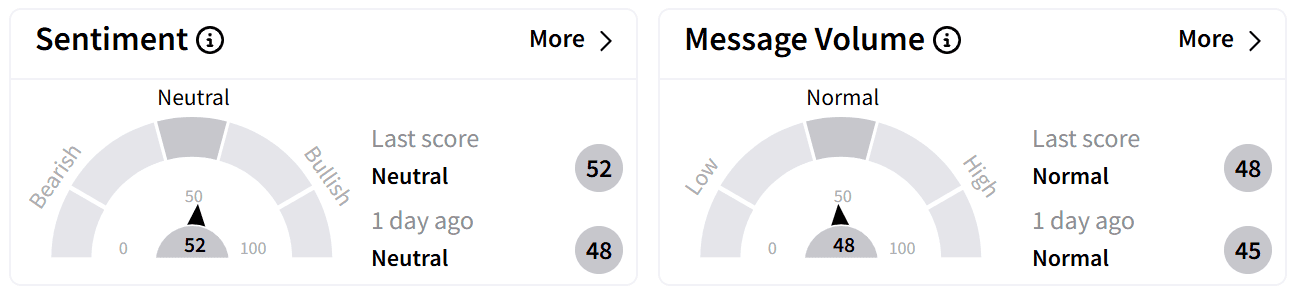

On Stocktwits, retail sentiment around ASML’s stock remained in the ‘neutral’ zone.

ASML shares are down around 28.5% over the past year and have largely traded sideways in 2024.

The stock has remained below its 200-day simple moving average since September.

Exchange Rate: €1 = $1.07

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_dow_jones_jpg_e152f04aaa.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_job_seekers_florida_resized_jpg_742e535d49.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Altcoins_ff3521c963.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_stock_price_bitcoin_OG_jpg_d43a7edd5e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_resized1_jpg_7f200ce842.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_credo_technology_resized_cdb4311141.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)