Advertisement|Remove ads.

ASTS Stock Tumbles 8% Premarket After Double Downgrade From Barclays

AST SpaceMobile, Inc.'s stock fell 8% in early premarket trading on Friday, sending the ticker among the top 10 on Stocktwits' trending list, after it was hit with a double downgrade.

Barclays slashed its rating on ASTS by two levels to 'Underweight' from 'Overweight,' while maintaining its $60 price target.

While direct-to-cellular will prove to be a "very attractive opportunity" and AST has key assets to succeed, the stock's valuation "has become excessive," the research firm said in an investor note, according to the summary on The Fly.

AST is building the first global space-based cellular network that works with regular mobile phones. Its main product, the BlueBird satellite constellation, aims to bring mobile broadband to remote and underserved areas worldwide and is aggressively launching new satellites into orbit.

Notably, the stock has soared 324% year-to-date and breached the $100 level for the first time on Thursday.

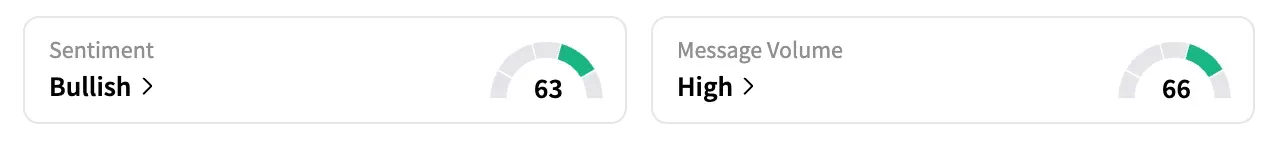

On Stocktwits, the retail sentiment for the stock was 'bullish' as of early Friday, unchanged from the previous day.

"$ASTS company is closer than ever to make tons of cash by changing the world deeply forever, whatever the price I buy," said one optimistic user.

According to Koyfin data, five of the 10 analysts covering AST rated the stock 'Buy' or higher, four rated it 'Hold,' and one rated it 'Strong Sell,' as of Thursday. Their average price target of $53.86 is about 40% lower than the stock's last close.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2252871865_jpg_74865c27a7.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_immunitybio_jpg_eb6402d336.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_OG_3_jpg_94334765ec.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_ondas_OG_jpg_05cf209e61.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_moonlake_jpg_376bc698df.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_QR_OG_jpg_08610d948a.webp)