Advertisement|Remove ads.

Aurora Mobile’s Global Contracts Surge Past $13M: Retail’s Exuberant

Aurora Mobile (JG) shares rose 2.5% in Thursday’s premarket after the company surpassed a major financial milestone in its push into global markets.

The company said its international cumulative contract value has crossed RMB100 million ($13.8 million) by the end of the first quarter (Q1) in 2025.

The China-based marketing and customer engagement firm continues to accelerate its overseas expansion through its signature product, EngageLab.

EngageLab is a platform launched in 2022 to serve international clients. It was designed with an emphasis on real-world applications and customized technical solutions and has drawn users from 37 different countries and territories.

Its widespread adoption has enabled the company to reduce reliance on its home market while strengthening its strategic footprint worldwide.

Aurora Mobile finalized new overseas agreements totaling more than RMB50 million during Q1. The company will recognize the associated revenue over time, based on the specific conditions and durations outlined in each contract.

The rapid increase in contract value reflects rising demand for integrated messaging and marketing tools tailored to global digital businesses.

“Breaking through RMB50 million in contract value for our overseas business in a single quarter is a historic milestone for our company. This achievement reflects the growing global recognition of EngageLab and its competitive advantage in multi-channel user engagement solutions,” said Chairman and CEO, Weidong Luo.

Aurora Mobile’s international strategy mirrors moves made by other Chinese tech firms looking to mitigate risks from a slowing domestic economy.

The company expects Q1 revenue growth of 35% to 40% year-on-year, to RMB87.0 million to RMB90.0 million, well above the previous guidance of RMB74.0 million to RMB77.5 million.

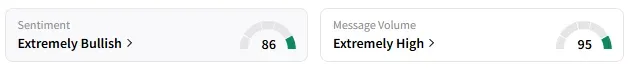

On Stocktwits, retail sentiment around Aurora Mobile remained in ‘extremely bullish’ territory.

Aurora Mobile stock has added 44.8% year-to-date and more than tripled in the past 12 months.

Also See: Bitcoin Smashes $111,000 As Record Rally Rolls On — And Retail Traders Can’t Get Enough

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Exchange Rate: 1 RMB = 0.14 USD

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2240705652_jpg_64172b74f3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Trade_Desk_jpg_e7ed8e2266.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_wall_street_bull_OG_jpg_791f8f3b40.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231786706_jpg_5f9940e890.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259293616_jpg_38a91a25a8.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Webull_stock_resized_jpg_48b42f4c8f.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)