Advertisement|Remove ads.

Australia’s Larvotto Rejects US Antimony Deal Over Valuation Concerns

- The Australian miner said that the offer materially undervalued the company.

- The initial offer included a fixed exchange ratio of 6 UAMY common stock shares for every 100 Larvotto shares.

- Larvotto’s Hillgrove project is expected to meet 7% of the world’s antimony demand upon full commissioning.

Australia’s Larvotto Resources rejected a buyout offer by the United States Antimony Corp (UAMY) on valuation concerns.

The American miner unveiled an offer earlier this month to pay Larvotto shareholders A$1.40 per share to acquire the remaining shares it does not own. U.S. Antimony already disclosed a 10% stake in the Australian miner before the offer.

Why Did Larvotto Reject UAMY’s Deal?

The Australian miner said the offer materially undervalued the company. The board took the decision after the implied offer value slipped to A$1.13 per Larvotto share from A$1.40, based on UAMY’s 5-day volume weighted average price to Oct. 24. The initial offer included a fixed exchange ratio of 6 UAMY common stock shares for every 100 Larvotto shares.

“The Board is confident that Larvotto’s intrinsic value and long-term growth potential significantly exceed the indicative value implied by the Offer,” Mark Tomlinson, Larvotto’s non-executive chair, said.

The company said it remains focused on its Hillgrove gold and antimony project, which is on track to achieve first production in 2026. “At current gold and antimony prices, the project’s capital payback is expected to be achieved within months of first production,” Tomlinson added.

Why Was UAMY Pushing For The Deal?

As per Larvotto’s draft feasibility report on the Hillgrove project, the mine is expected to meet 7% of the world’s antimony requirements after it is fully commissioned. The deal could have helped the combined company tap into the growing demand for the critical mineral amid export restrictions imposed by China.

Last month, U.S. Antimony secured a five-year contract worth up to $245 million from the U.S. Defense Logistics Agency to contribute to the antimony stockpile. Earlier in October, it secured $25 million in capital through a securities purchase agreement with a prominent long-only mutual fund to spend on its growth plans.

What Is Retail Thinking?

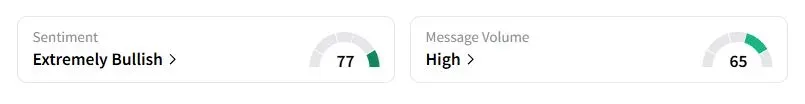

Retail sentiment on Stocktwits about UAMY stock was still in the ‘extremely bullish’ territory late Sunday, with the ticker trending on top.

One user wrote that Larvotto executives might have believed they had the stronger hand following the U.S.-Australia agreement on critical minerals.

“We don’t have to own everything. At the end of the day, both countries need each other; therefore, we will have some sort of deal beneficial to both,” another trader said.

United States Antimony stock has jumped over sixfold this year. However, the stock’s recent gains could come under threat after U.S. Treasury Secretary Scott Bessent indicated that China might pause its restrictions on rare-earth exports. While antimony is not part of the rare earth group, antimony miners have moved in tandem with rare earth stocks in recent years in response to developments related to China.

Also See: Sagimet Biosciences Stock Soars After Positive Data For Experimental Drug In Acne Study

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2217651250_jpg_908ef236f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2194622714_jpg_c18475d557.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)