Advertisement|Remove ads.

Autodesk Stock Drops On Potential Acquisition Of Peer PTC, But Retail’s Exuberant

Software firm Autodesk Inc. (ADSK) is reportedly exploring a potential takeover bid for fellow engineering software provider PTC Inc.

Following the report, Autodesk stock traded 6.9% lower in Thursday’s morning session.

According to a Bloomberg report citing anonymous insiders, Autodesk is collaborating with advisors to structure a possible cash-and-stock deal for Boston-based PTC.

Established in the 1980s, PTC provides design software used in sectors like aerospace, computing, and medical devices.

This potential transaction follows PTC’s market value of about $25 billion and growing interest from other firms.

Autodesk has not reached a definitive agreement, and insiders, according to the report, caution that the company could still walk away from the potential acquisition.

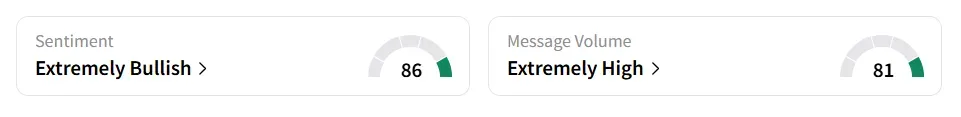

Despite the stock’s slump, on Stocktwits, retail sentiment toward Autodesk improved to ‘extremely bullish’ from ‘bullish’ the previous day. Message volume jumped as well to ‘extremely high’ from ‘high’ levels in the last 24 hours.

A Stocktwits user professed confidence in the company and said the firm would grow with a merger or buyout of PTC.

The development comes during a wave of consolidation in the industrial software sector, driven by growing interest in AI-powered solutions.

Last year, Siemens AG acquired Altair Engineering in a deal valued at around $10 billion, while Synopsys Inc. (SNPS) announced a $34 billion acquisition of Ansys Inc. (ANSS), which is still pending regulatory clearance in China.

Earlier this year, activist investor Starboard Value acquired a position in Autodesk. It began pushing for changes to the board, citing worries about the company’s earnings track record and handling of accounting issues.

Autodesk stock has lost over 3% year-to-date and has added over 15% in the past 12 months.

Also See: TSMC H1 Revenue Surges 40% Despite June Dip: Retail Stays Confident

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2258839311_jpg_35f0914ce1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2198547045_jpg_e6c30993de.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2158238458_jpg_48ab7af27c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_elizabeth_warren_original_2_jpg_bd4f84b387.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2164981884_1_jpg_100f5d0da3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2212700544_jpg_8378e13131.webp)