Advertisement|Remove ads.

EU Export Approval Sparks Rally In Avanti Feeds, Apex Frozen Foods, Coastal Corporation

Shares of Indian seafood exporters rallied sharply on Wednesday after the European Union approved 102 new Indian fishery establishments for exports.

Avanti Feeds was up 10.6% at ₹729, while Apex Frozen Foods surged 14.4% to ₹251. Coastal Corporation hit the upper circuit limit at 20%, while Waterbase advanced up to 8.5% in early trade. IFB Agro Industries traded 2.3% higher.

EU Approval

On Tuesday, the European Union (EU) approved 102 additional Indian fishery establishments for exports, a move that could significantly boost India’s seafood trade with one of its most lucrative markets.

The approval underscores India’s growing export of aquaculture products, particularly shrimps and cephalopods such as squid, cuttlefish, and octopus, which are in high demand in European markets.

Given that the US recently imposed steep tariffs on Indian seafood, the EU’s decision is timely, offering exporters an alternative growth market. China, Japan, and Vietnam are the other key markets for Indian marine products.

According to reports, the move is expected to increase India’s export capacity by nearly 16%. The Commerce Ministry said the approval could immediately lift export volumes by more than 20%, while also sending a strong signal ahead of the 13th round of Free Trade Agreement (FTA) talks between India and the EU.

Avanti Feeds and Apex Frozen Foods stand to benefit significantly from the EU move, given their increasing reliance on that market. For Avanti Feeds, the EU reportedly contributed 17.4% of FY25 revenues, while for Apex Frozen Foods, the share rose to 39% in FY25 from 26% the previous year.

Expert Take

According to Nidhi Saxena, a SEBI-registered investment advisor at Trade Bond, the EU’s approval of 102 new Indian fishery units marks a significant shift for the seafood sector. With exports to Europe expected to rise by nearly 20%, this move could help cushion the impact of steep U.S. tariffs on shrimp imports, which have been a major challenge for the industry.

Beyond the near-term boost, it also signals growing market diversification, reducing dependency on a single region, a structurally positive trend for valuations.

Among key stocks, Avanti Feeds appears steady, boasting a strong balance sheet and stable margins. Trading at 16.9x P/E, valuations remain reasonable with support at ₹705 - ₹710 and resistance at ₹735 - ₹750, Saxena said.

Apex Frozen Foods has rallied 13% in five days, making it a momentum play, but its 84x P/E demands earnings growth to justify levels; support is seen at ₹240 - ₹245 and resistance at ₹258 - ₹265, she added.

Coastal Corporation, a high-beta small cap, has gained 11% in a month and could benefit further if EU orders expand, with support at ₹33 and resistance at ₹39 - ₹42, Saxena said.

Overall, the EU approval supports a medium-term positive outlook, though near-term volatility is likely as stocks digest the rally.

Stock Watch

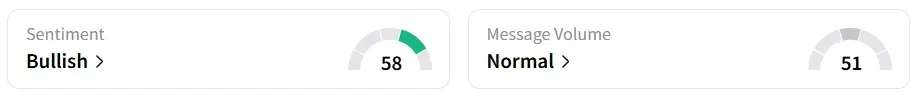

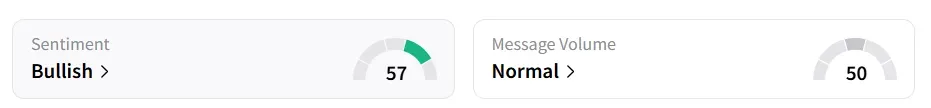

Retail sentiment for both companies turned ‘bullish’ on Stocktwits, with Avanti Feeds being among the top 5 trending stocks on the platform.

Sentiment for Coastal Corp, Waterbase, and IFB Agro remained ‘neutral’.

Year-to-date, Avanti Feeds’ stock has gained 8.6%, while Apex shares have shed over 7%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2199618807_jpg_0e9f26c6c5.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262651778_jpg_54075aa1d9.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2246580703_jpg_9700e1e7e8.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2189643067_jpg_243b1172b6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1494564204_jpg_be6f667516.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259256580_jpg_e72ea8ddc5.webp)