Advertisement|Remove ads.

Axis Bank In Consolidation Mode: What Should Investors Track Next? SEBI Analyst Weighs In

India’s third-largest private sector bank has seen a 2% decline in the last one month. What’s the road ahead for this banking stock? What are the key factors to watch in the second quarter?

SEBI-registered analyst Deepak Pal shared his outlook on Stocktwits.

He noted that Axis Bank stock recently broke its short-term support zone around ₹1,100 and is now consolidating near ₹1,075–1,080 levels. Its daily chart shows the stock trading below 20, 50, 100, and 200-day moving averages, indicating weakness.

Additionally, the parabolic SAR still indicates a bearish trend. And while the MACD is negative, it showed signs of flattening, suggesting selling pressure is slowing. The Relative Strength Index (RSi) at 42 reflects a weak momentum zone.

Pal identified support at ₹1,050, with resistance at ₹1,120. If Axis Bank sustains above ₹1,120, recovery may begin. But a breakdown below ₹1,050 could drag the stock to ₹1,020–₹1,000 levels.

Fundamental Watch

The bank’s FY25 performance shows a steady loan book growth, stable NIMs (Net Interest Margins), and improvement in asset quality. CASA deposits remain healthy, indicating a strong retail franchise. And profitability improved due to lower credit costs and stable provisions.

Pal added that its focus on retail lending, digital initiatives & SME financing and strategic investments in digital banking platforms have helped increase the customer base. And a comfortable capital adequacy ratio supports future growth.

Triggers To Watch

Pal said that an improvement is expected in loan growth & asset quality in the upcoming second-quarter (Q2 FY26) earnings. Also keep an eye on any rate change decisions by India’s central bank, which will directly impact margins.

He also said that if there is a sectoral rotation in market, with BFSI turning favorable again, then Axis may see fresh inflows. Management commentary on expansion & credit demand will guide medium-term outlook.

What Should Investors Do?

In the short-term Pal expects Axis Bank to remain rangebound between ₹1,050–₹1,120. A breakout on either side will decide the trend.

Over the medium-term, if credit growth sustains, Axis may head towards ₹1,200+ levels in the coming quarters. And over the long term, Axis remains a key private banking play, driven by strong fundamentals, digital banking growth, and improving asset quality.

What Is The Retail Mood?

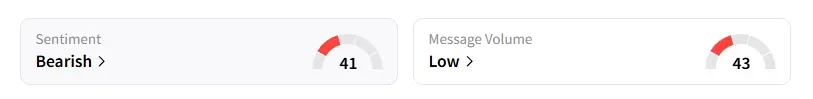

Data on Stocktwits shows that retail sentiment has been in the ‘bearish’ territory since the end of July.

Axis Bank shares are flat for the year so far.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2259503553_jpg_13fb8f2e88.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_trader_stock_chart_resized_861d098b1f.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_122032465_jpg_9592f3bcfd.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Novavax_building_93bfe3bf8c.jpeg)