Advertisement|Remove ads.

Axis Bank Shares: SEBI RA Deepak Pal Recommends Buy-on-Dips Strategy

Axis Bank is on the analysts’ radar after an 18% run-up in the last three months.

At the time of writing, Axis Bank shares were trading at ₹1,220.2.

SEBI-registered analyst Deepak Pal said Axis Bank is among India’s top three private sector banks, highlighting its capital adequacy ratio of 17.6% and return on equity of 18.3%.

He said the bank’s CASA ratio stands at 44.4% and noted its acquisition of Citibank India’s consumer business has improved its retail presence.

On the technical side, Pal said the stock rebounded from ₹1,151.90 on June 6, the day of the RBI policy, and has shown consistent buying since.

He noted that over the past three sessions, it has taken support at the 14-day Exponential Moving Average near ₹1,195.

Pal said the chart shows the stock is moving independently of broader market sentiment and is showing resilience to geopolitical developments.

He recommended a buy-on-dips approach, identifying support near ₹1,175 and a potential upside towards ₹1,250.

Axis Bank reported a net profit of ₹25,719 crore and net interest income of ₹51,732 crore, with a net interest margin of 4.06% in its fourth quarter (Q4FY25).

Meanwhile, gross and net Non-Performing Asset ratios stood at 1.43% and 0.31%, respectively, with provision coverage above 75%.

In other news, the lender said it allotted 3.12 lakh equity shares under its ESOP and RSU schemes, increasing its paid-up capital to ₹6,202 crore.

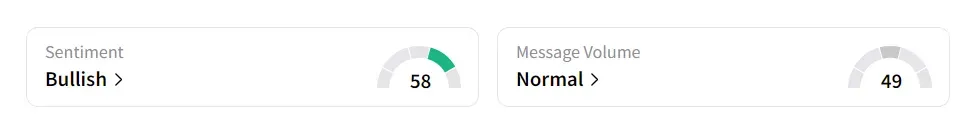

On Stocktwits, retail sentiment was ‘bullish’ amid ‘normal’ message volume.

The stock has risen 13.9% so far in 2025.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2226817028_jpg_d2fd9156db.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_elerian_resized_jpg_49303b41ee.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_netflix_paramount_warner_bros_jpg_c959c8a9e4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_original_jpg_285085becb.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_atm_original_jpg_afc73e9be7.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262712431_1_jpg_6f471d2542.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)