Advertisement|Remove ads.

AZZ Stock Falls After Q2 Revenue Narrowly Misses Estimates, But Retail’s Happy With Profit Beat

AZZ Inc. stock fell 6% on Thursday morning, despite the company’s second quarter earnings meeting analyst estimates, but retail sentiment was upbeat due to other factors.

For its second quarter, the provider of metal coating solutions, posted adjusted diluted EPS of $1.37, up 7.9% from the same period last year, beating analyst estimates of $1.31.

It narrowly met analyst expectations for revenues that stood at $409.1 million, up 2.6% year-on-year, compared to estimated $409.57 million.

The company also reaffirmed its full-year (fiscal 2025) revenue outlook range of $1.525 billion-$1.625 billion, whose midpoint fell below Wall Street estimates of $1.61 billion, according to thefly.com. Its outlook for adjusted EPS is between $4.70 and $5.10.

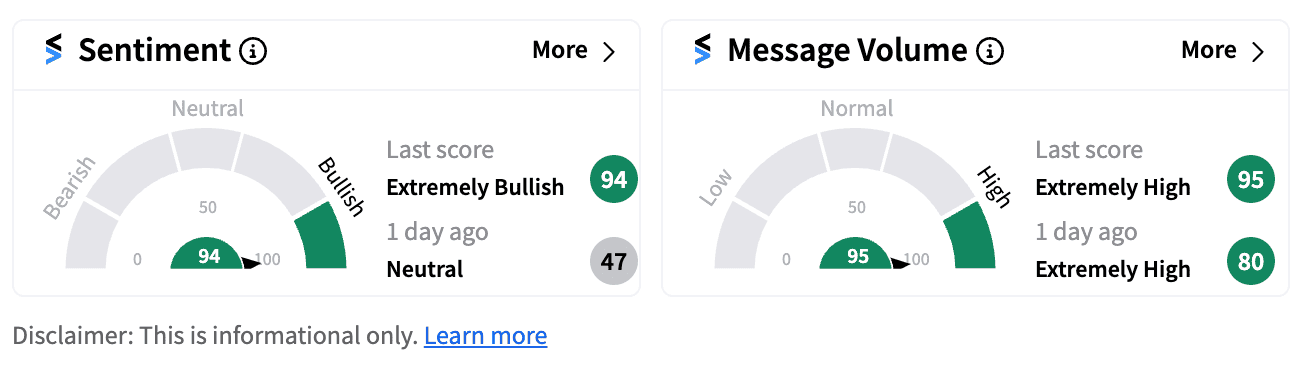

Retail sentiment on the stock turned ‘extremely bullish’ following the results from neutral a day ago. Message volumes continued to be extremely high.

Adjusted net income stood at $41.3 million, up 11% from the previous year. The company has announced a cash dividend of $0.17 per share for common shareholders.

"Focused execution and seasonal strength contributed to second quarter sales of $409.0 million, up 2.6% over the prior year, and Adjusted EPS of $1.37,” Tom Ferguson, AZZ President and CEO said in a statement.

AZZ also announced efforts to shore up its balance sheet. It is aiming for at least $100 million debt reduction this year. It also refinanced a term loan recently for a cheaper interest rate. At the end of Q2, its net leverage stood at about 2.7x trailing 12-months EBITDA.

AZZ’s company's stock is up 33% year-to-date. It hit an all time high of $86.75 in July.

For updates and corrections, email newsroom@stocktwits.com

/filters:format(webp)https://news.stocktwits-cdn.com/large_John_Malone_jpg_9269650f8b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rising_chart_jpg_afe9e31de1.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_elerian_resized_jpg_49303b41ee.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/04/united-breweries-2024-04-74a919e2e0dafbbdfdb8ab800b54d0dd.jpg)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/cnbctv18logo.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_general_motors_jpg_f8e71254bc.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://images.cnbctv18.com/uploads/2024/09/vala-afshar-2024-09-d838b1e7772cddbb4832364559262eea.jpg)