Advertisement|Remove ads.

Alibaba’s Pre-Market Rally Fizzles On Revenue Miss: Retail Chatter Heats Up

Shares of Alibaba Group Holding Ltd ($BABA) fell more than 3% on Friday, reversing pre-market gains, after the Chinese e-commerce giant reported a revenue miss despite stronger-than-expected fiscal second-quarter (Q2) profit.

Net income climbed to 43.55 billion yuan ($6.21 billion), or 18.17 yuan per American depositary share (ADS), significantly up from 29.7 billion yuan, or 10.77 yuan per ADS, in the same quarter last year.

Adjusted earnings per ADS, excluding nonrecurring items, fell to 15.06 yuan from 15.63 yuan but still surpassed the FactSet consensus of 14.82 yuan.

Revenue increased by 5.2% to 236.50 billion yuan ($33.70 billion), although it fell short of analysts’ expectations of 239.45 billion yuan.

The standout performer was Alibaba’s cloud intelligence group, with revenue rising 7.1% to 29.61 billion yuan, slightly beating the expectation of 29.52 billion yuan.

Alibaba highlighted that AI-driven revenue continued to grow at a triple-digit percentage rate for the fifth consecutive quarter.

Alibaba’s statement emphasized its commitment to investing in AI infrastructure to capture growing demand for cloud adoption in China. “Alibaba Cloud has gained notable recognition as the service provider of choice in China for public cloud and AI training and applications,” the company noted.

However, its core e-commerce platforms, Taobao and Tmall, posted a modest 1.4% revenue increase to 98.99 billion yuan, missing the FactSet forecast of 104.34 billion yuan.

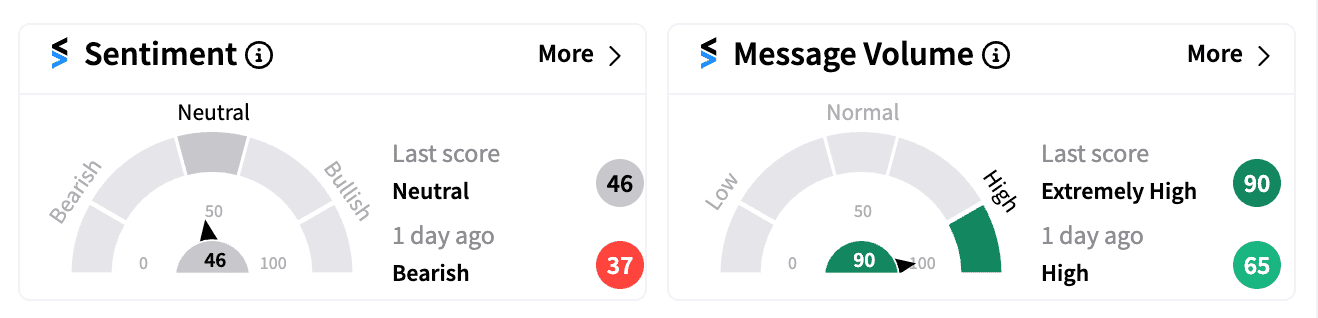

Retail sentiment on Stocktwits turned more optimistic from a day earlier, although it stayed in the 'neutral zone', with $BABA emerging as the top trending ticker.

A bullish post noted the profitability boost from Alipay operator Ant Group, which saw its quarterly profit jump from 846 million yuan to 2.48 billion yuan.

Another user highlighted Alibaba’s aggressive buyback strategy. The company has $22 billion remaining under its share repurchase authorization, which is valid through March 2027.

Alibaba’s earnings have been weighed down by thinning margins due to intense competition from rivals JD.com ($JD) and PDD Holdings ($PDD).

Additionally, the potential threat of higher tariffs on Chinese imports under the incoming Trump administration has added pressure on the stock.

Year-to-date, BABA shares have gained nearly 17%, slightly outperforming the iShares MSCI China ETF (MCHI), but trailing the broader S&P 500’s 25% rally.

For updates and corrections, email newsroom@stocktwits.com

Read next: 5 Dow 30 Stocks With Sharp Activity Spike On Stocktwits As Trading Week Draws To Close

Editor’s note: This story has been updated to reflect stock price movements during regular trading hours and a revised headline.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2233918556_jpg_1c5248e175.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Anushka_Basu_make_me_smile_in_the_picture_b92832aa_af59_4141_aacc_4180d2241ba8_1_2_png_1086e0ed8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227669377_jpg_9a115c3623.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227231004_jpg_0de480c6f4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2254924041_jpg_892ccf911d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_1234736300_jpg_881ee00045.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2218899763_jpg_5d8b51f97d.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)