Advertisement|Remove ads.

Baidu Reportedly Weighs Hong Kong Primary Listing Amid Rising US-China Market Tensions

- Currently, Baidu trades on the Nasdaq and also maintains a secondary listing on the Hong Kong Stock Exchange.

- The contemplated upgrade could allow broader participation from mainland Chinese capital.

- On January 2, Baidu said that its AI chip unit, Kunlunxin, submitted an application to the Hong Kong Stock Exchange for a possible spin-off.

Baidu Inc. (BIDU) is reportedly evaluating a move that could significantly reshape how global and mainland investors access its shares as the Chinese technology and AI powerhouse is in early discussions about shifting its Hong Kong listing to “primary” status.

According to a Bloomberg report, the change is expected to broaden its investor base and potentially shield the firm from geopolitical risks tied to U.S.-China tensions.

Context Of The Review

Currently, Baidu trades on the Nasdaq and also maintains a secondary listing on the Hong Kong Stock Exchange.

According to the report, this structure makes its shares more accessible in Asia but leaves mainland Chinese investors unable to trade them through cross-border channels like Stock Connect, which links exchanges in Hong Kong and the Chinese mainland.

The contemplated upgrade could change that dynamic, allowing broader participation from mainland Chinese capital. Baidu stock traded over 2% higher in Wednesday’s premarket.

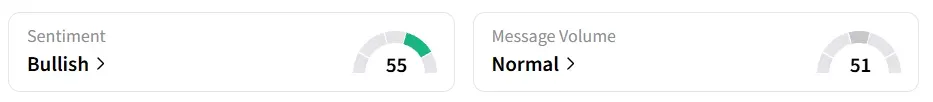

On Stocktwits, retail sentiment around the stock remained in ‘bullish’ territory while message volume shifted to ‘normal’ from ‘high’ levels in 24 hours.

Geopolitical And Market Drivers

A primary listing would help Baidu mitigate the threat of tightening U.S. regulatory pressures, especially since Chinese tech firms have faced heightened scrutiny and potential delisting risks on U.S. exchanges.

According to a CNBC report, in 2025, President Donald Trump’s “America First Investment Policy” memorandum raised renewed concerns about whether Chinese companies could be delisted from U.S. stock exchanges.

Baidu’s Strategic Growth And AI Focus

The latest move comes after Baidu said that its AI chip unit, Kunlunxin, submitted an application to the Hong Kong Stock Exchange on January 1, setting the stage for a possible spin-off and separate debut.

Baidu’s consideration attains importance as China aims to close the AI dominance gap. According to a Financial Times report, Microsoft President Brad Smith said U.S. artificial intelligence companies are losing ground to Chinese competitors in attracting users outside Western countries.

BIDU stock has gained over 87% in the last 12 months.

Also See: Visa Teams Up With BVNK To Enable Stablecoin Payments Amid Washington’s Push For Clarity

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_iova_stock_jpg_ac0924fcdd.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Stock_chart_image_d3ebab70ec.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2228840051_jpg_b05caad6aa.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2262920033_jpg_f596c67fd3.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2243565350_jpg_6cd80dbe6d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2227994766_jpg_090ba3c9b6.webp)