Advertisement|Remove ads.

Baidu Rises As AI, Cloud Power Q1 Earnings: Retails Turns Extremely Bullish

Shares of Chinese technology company Baidu Inc. (BIDU) traded 2.2% higher in Wednesday’s premarket after the company reported better-than-expected first-quarter earnings.

Revenue grew 3% year-on-year (YoY) to RMB32.5 billion ($4.47 billion), beating the analyst consensus estimate of RMB31 billion, as per Finchat data.

Baidu leaned further into artificial intelligence (AI) and cloud services to offset declines in its traditional advertising business.

The bulk of Baidu’s revenue continues to come from its core business, which brought in RMB25.5 billion, up 7% YoY.

Non-marketing revenue increased by 40% YoY to RMB9.4 billion. However, online advertising revenue fell 6% YoY to RMB16.0 billion, underscoring the shift in focus away from traditional income streams.

Baidu’s video platform, iQIYI, generated RMB7.2 billion, marking a 9% decline from the previous year.

Adjusted earnings per share (EPS) of RMB18.54 also beat the consensus estimate of RMB13.84.

Operational costs increased to RMB17.5 billion, driven by rising traffic acquisition and cloud service-related expenses.

Baidu’s spending on sales, marketing, and administration climbed 10% YoY to RMB5.9 billion, largely due to increased promotional activities.

In contrast, R&D costs dropped 15% to RMB4.5 billion, thanks to cuts in personnel spending.

Operating income declined 18%, and the operating margin contracted by 300 basis points to 14%. Adjusted earnings before interest, tax, depreciation, and amortization (EBITDA) fell 13% to RMB7.2 billion, with a margin of 22%.

Baidu held RMB49.2 billion in cash and equivalents as of March 31.

"Baidu Core revenue grew 7% year over year in the first quarter, driven by the accelerating momentum of AI Cloud, which surged 42% year over year,” said CEO Robin Li.

“The strong performance of our AI Cloud business underscores the growing market recognition of our distinctive strength in providing full-stack AI products and solutions with a highly competitive price-performance advantage.”

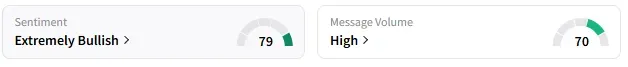

On Stocktwits, retail sentiment around Baidu improved to ‘extremely bullish’ territory from ‘bullish’ the previous day.

A Stocktwits user called the firm a cash machine.

Another user was surprised by the stock rally.

Baidu stock has gained 5.9% in 2025 and lost 15% in the past 12 months.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Exchange Rate: 1 RMB = 0.14 USD

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2229918735_jpg_e905cbd5e3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Aashika_Suresh_Profile_Picture_jpg_2acd6f446c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Netflix_jpg_ed6fa4554b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/shivani_photo_jpg_dd6e01afa4.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_paramount_skydance_warner_bros_discovery_jpg_709742214d.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Broadcom_jpg_f302b01f15.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Rounak_Author_Image_7607005b05.png)

/filters:format(webp)https://news.stocktwits-cdn.com/large_new_york_stock_exchange_jpg_e1f85c0d8c.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2218181288_jpg_d22b8a81ff.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/vivekkrishnanphotography_58_jpg_0e45f66a62.webp)