Advertisement|Remove ads.

Baidu Stock Slips After Dip In Advertising Revenue Overshadows Q4 Earnings Beat: Retail’s Still Impressed

Shares of Baidu, Inc. (BIDU) slipped in Tuesday’s premarket session despite the Chinese search engine’s forecast-beating fiscal year 2024 fourth-quarter results. The negative stock reaction may have been due to weak advertising revenue.

The headline numbers for the fourth quarter are as follows:

- Adjusted earnings per share (EPS): 19.18 yuan ($2.63) vs. 21.86 yuan a year earlier, and the $1.97 consensus estimate

- Revenue: 34.12 billion yuan ($4.68 billion), down 2% year over year (YoY) from 34.95 billion yuan last year but exceeding the $4.57-billion consensus

- Adjusted earnings before interest, tax, depreciation, and amortization (EBITDA): 6.95 billion yuan ($952 million) vs. 9.06 billion yuan last year

- Adjusted EBITDA margin: 20% vs. 26% last year

The company noted that core Baidu revenue, which includes search-based, feed-based, and other online marketing services, as well as products and services from its new AI initiatives, rose 1% YoY to 27.7 billion yuan ($3.80 billion). Thanks to strong AI Cloud performance, non-online marketing revenue climbed 18%, offsetting a 7% decline in online marketing revenue or advertising revenue.

Revenue from iQIYI video-on-demand over-the-top streaming service fell 14% to 6.6 billion yuan.

Baidu co-founder and CEO Robin Li said, “2024 marked a pivotal year in our ongoing transformation from an internet-centric to an [artificial intelligence] AI-first business.” He said AI Cloud gained momentum, and the company has made search more AI-native to deliver a better user experience.

He added that the company’s investment in Apollo Go robotaxi service is yielding fruits.

Baidu said its ERNIE chatbot handled about 1.65 billion (Application Programming Interface (API) calls in December, with external API calls rising 178% quarter-over-quarter. The Apollo Go ride-hailing service provided more than 1.1 million rides in the fourth quarter, up 216% YoY and 83% higher in the previous quarter.

Baidu App’s monthly active users (MAU) rose 2% YoY to 679 million in December.

CEO Li said, "With our strategic foresight increasingly validated, we expect our AI investments to deliver more significant results in 2025."

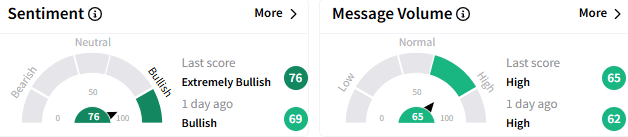

On Stocktwits, sentiment toward Baidu shares turned ‘extremely bullish’ (75/100) from the ‘bullish’ mood that prevailed a day ago. The message volume remained at a ‘high’ level.

A watcher contended that Baidu is ‘undervalued’ going by Apollo Go’s metrics relative to Alphabet, Inc.’s (GOOG) (GOOGL) Waymo.

Another user said the earnings were “solid” and positioned for a stock move toward the $100 level.

Baidu ADS listed on the Nasdaq shed 2.24% to $95.30 in premarket trading. It has gained 15.6% so far this year.

(1 yuan = $0.14)

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2260447662_jpg_cd246b74f6.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2254924116_jpg_d54ffea07e.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_US_stocks_3e2253bcca.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/Revised_Profile_JPG_0e0afdf5e2.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2228900989_jpg_e94daec744.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_1445160636_jpg_9759816169.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Bitcoin_Red_OG_jpg_d64521f99a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)