Advertisement|Remove ads.

Bajaj Finance: SEBI RA Rohit Mehta Flags Bullish Breakout Ahead Of Q1 Earnings

India’s largest non-banking lender, Bajaj Finance, is scheduled to report its quarterly earnings on Thursday. According to reports, the company is expected to post double-digit growth in both net interest income and net profit for its June quarter (Q1 FY26). The increase in key figures is likely to be driven by strong loan expansion and easing credit costs.

From a technical perspective, Bajaj Finance currently has a bullish chart setup, said SEBI-registered analyst Rohit Mehta.

The stock recently confirmed a cup and handle breakout on the weekly chart, rallying above the ₹820 - ₹840 resistance band. Volume trends indicate continued buying interest, Mehta said.

A support zone can be seen in the ₹760 - ₹800 range, the analyst added.

Bajaj Finance shares were down 0.7% at ₹961.50 in early trade on Thursday.

Fundamentally, the company has a solid 25.9% profit CAGR over five years and a 17.4% dividend payout ratio. However, valuations remain rich at 6.12x book value, while the company’s low interest coverage ratio also warrants caution, according to Mehta.

Bajaj Finance has consistently delivered strong earnings. In Q4 FY25, revenue increased by 23.66%, while profit rose by 11.16%. EPS also improved to 16.67%.

Foreign investors (FIIs) increased their stake to 21.71% from 21.45% in the June quarter, while domestic investors (DIIs) slightly trimmed holdings. Promoter stake remained unchanged at 54.73%.

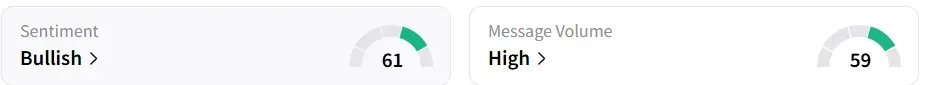

Retail was hopeful of the company being aligned with the Q1 estimates as sentiment on Stocktwits turned ‘bullish’ ahead of the results, amid ‘high’ message volumes. It was ‘neutral’ a day earlier.

With a bullish chart and stable fundamentals, Q1 results could decide the next leg of the rally.

For updates and corrections, email newsroom[at]stocktwits[dot]com

/filters:format(webp)https://news.stocktwits-cdn.com/large_verastem_jpg_8ed70d9d9a.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_bitcoin_with_others_OG_jpg_86ee42eaf9.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/Prabhjote_DP_67623a9828.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_nio_jpg_4ad189441e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Rigetti_resized_jpg_4e393f1208.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_robinhood_bitcoin_OG_jpg_fbd13fff2e.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_iren_OG_jpg_ba842dd11a.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)