Advertisement|Remove ads.

Bank Of Maharashtra Consolidating Ahead Of Q1 Results: SEBI RA Says Long-term Trend Remains Bullish

Bank of Maharashtra is set to announce its Q1FY26 results later today, and with robust credit growth of 15.36% to ₹2.41 lakh crore in the first quarter, investors are eyeing whether strong earnings could spark a fresh uptrend in the stock.

Bank of Maharashtra is currently in a healthy correction phase after a sharp rally. The stock has shed 1.9% over the past week.

The stock is showing signs of resilience as it consolidates above a key weekly support zone between ₹50 - ₹54, said SEBI-registered analyst Rohit Mehta. Key resistance lies at its all-time high price of ₹71.21.

While the long-term trend remains bullish, driven by a strong recovery from multi-year lows, recent price action reflects a correction, he said.

Technical indicators suggest that as long as the support holds, the stock could attempt a base formation and eventual reversal. Accumulation patterns remain strong, with sustained volume growth observed since 2020, Mehta said.

From a fundamental standpoint, the bank’s financial performance remains encouraging. In the March quarter, revenue rose 23.12% while financing profit surged 126%. Shareholding trends also show rising foreign institutional investors (FII) interest, while promoter stake remains stable at 79.60%.

On the positives, Bank of Maharashtra boasts a five-year profit CAGR of nearly 70%, improved working capital efficiency, and a healthy dividend payout ratio of 26.2%. However, concerns remain over its low interest coverage ratio, high contingent liabilities of around ₹47,914 crore, and a potentially unsustainable tax rate, the analyst added.

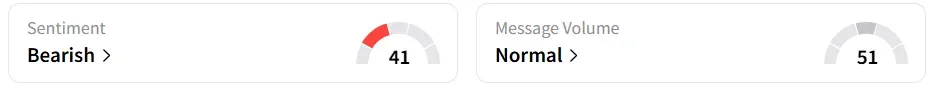

Retail sentiment on Stocktwits continued to remain ‘bearish’.

The stock is currently trading at ₹56.37, down 1.5% in early trade. Year-to-date (YTD) gains stand at 8.2%.

For updates and corrections, email newsroom[at]stocktwits[dot]com.

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2195880631_jpg_5d50833996.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/IMG_9209_1_d9c1acde92.jpeg)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2227553102_jpg_9cb79c1b5b.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_4530_jpeg_a09abb56e6.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2236688965_jpg_b00d009983.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/IMG_8805_JPG_6768aaedc3.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/Getty_Images_2231423801_jpg_f64bcdbb33.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/unnamed_jpg_9dff551b50.webp)

/filters:format(webp)https://news.stocktwits-cdn.com/large_Getty_Images_2242062032_jpg_b5e44cfa75.webp)

/filters:format(webp)https://st-everywhere-cms-prod.s3.us-east-1.amazonaws.com/large_Trade_desk_logo_resized_c0229eb2ab.jpg)

/filters:format(webp)https://news.stocktwits-cdn.com/jaiveer_jpg_280ad67f36.webp)